It’s been a bloodbath for the “apes” — the Reddit/social media meme stock traders doing battle with the hedge funds.

AMC failed to find more momentum and is back to being a $20 stock.

To be fair, AMC used to be in the $5-10 range leading up to the January 2020 meme stock frenzy. Investors who got in early enough came out winning.

But anyone who fell for the classic “buy the trend because of the hype” and entered at $70 is now freaking out.

Easy to see why…

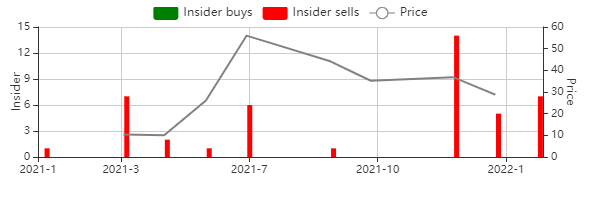

Just take a look at how fast the insiders have been jumping ship!

Here are this month’s AMC insider sales alone:

- Chris Cox, Chief Accounting Officer: Reduced position by 90%.

- John McDonald, EVP US Operations: Reduced position by 70%

- Stephen Colanero, CMO: Reduced position by 100%.

- Elizabeth Frank, Chief Content Officer: Reduced position by 93%

- Sean Goodman, CFO: Reduced position by 94%.

- Kevin Connor, General Counsel: Reduced position by 100%

And then, the big one:

Adam Aron — CEO and Chairman of the Board — cut his position by 60%, selling 312,000 shares.

This pulled $7 million out of the market.

Like I said, everyone’s bailing — and they’ve been doing it for months.

Now, here’s the charitable interpretation of this:

At Insiders Exposed, we don’t take bearish bets on insider sales because, as Peter Lynch would say:

“Insiders might sell their shares for any number of reasons…”

Maybe they’ve got a massive tax bill they’ve got to liquidate (looking at you, Elon).

Maybe their financial advisor barked at them for putting all their eggs in one position.

Maybe they’re getting a divorce and have to sell half.

Who knows.

Yet, you do know that if an insider is buying…

That’s a different story.

As Lynch explains once again with the 2nd half of his quote from earlier:

“They buy them (company shares) for only one: they think the price will rise.”

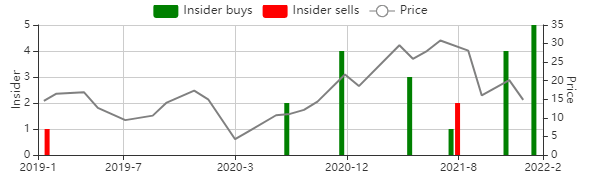

We’re seeing lots of insider buying in another “meme” stock that’s taken a beating for a while:

This name had monster runs alongside GME and AMC and has also seen a decent selloff over the past few months…

And during that time, insiders have been picking up some serious size.

In January, we saw 5 separate insiders purchase stock. In November, we saw 4 insiders.

These are called “cluster buys.”

We actively look for these because they show group conviction in a stock.

If this name just retests its pivot highs from November…

We’re looking for at least a 60% potential return on the stock.

And if you use options…

Then you have the potential to earn at least 273% on the option we’re looking at.

This trade is going out to our Insiders Exposed members TODAY.

If you want access…

Check out my insider trading webinar and I’ll explain how to join IE towards the end.