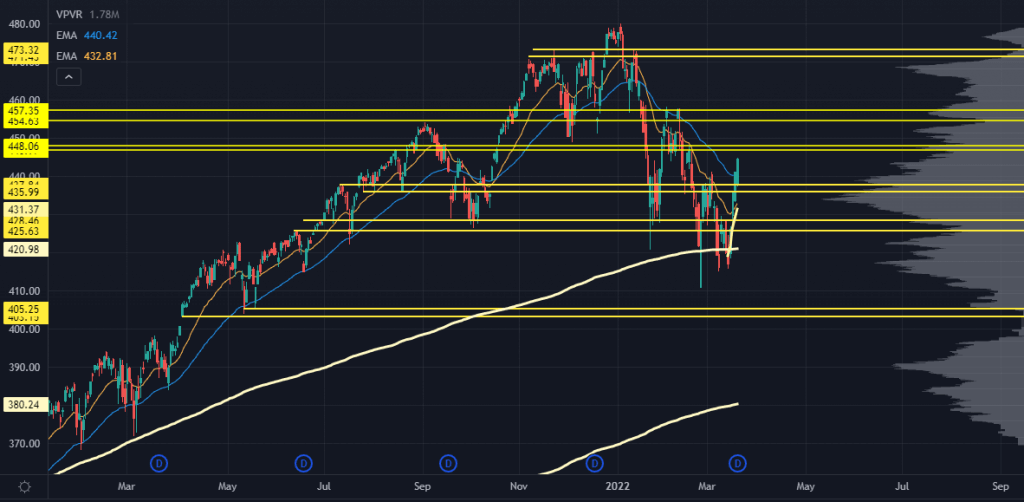

SPY

We can call this a bear market rally for now.

For this to have legs, we need to know the nature of the pullback. Plus, we have to see whether these prices can be accepted.

Simply put:

We don’t have enough information yet.

I’m aware that after this kind of move, every financial pundit will use the phrase “not out of the woods yet.” But for the moment, that’s the best way to call it.

It’s possible the past two months have churned and chopped enough weak hands out of the market…

And boy, the market sure loves to rip higher with fewer participants on board.

We also just had a long stretch of highly elevated risk premiums, but we’re finally coming off that. Don’t be shocked if this market can’t top out until we see the VIX crack 20 first.

Yes, we’re dealing with “binary” risks on a geopolitical scale. And I won’t comment on that because it’s not my area of expertise. In terms of market structure, the upside has better odds if the market keeps a solid bid into the next pullback.

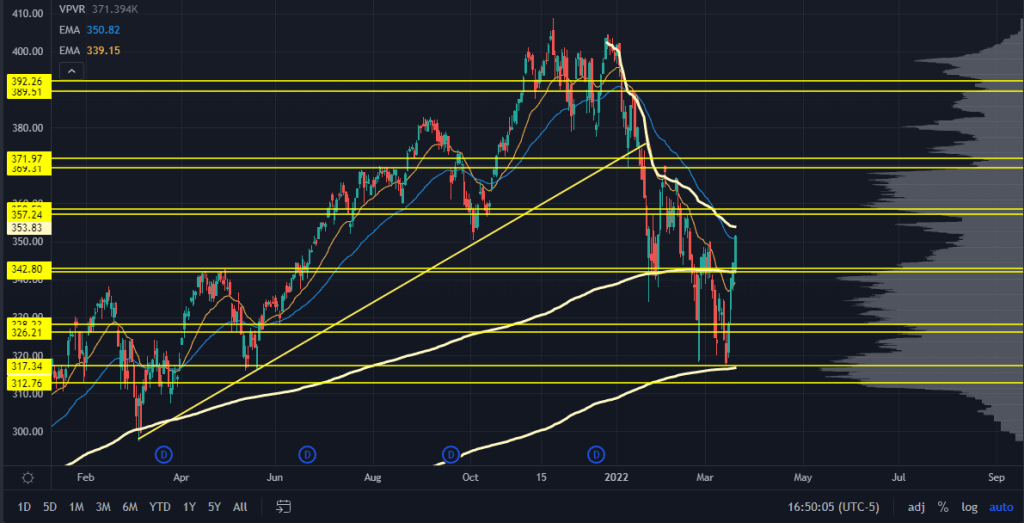

QQQ

Our Volume Weighted Average Prices (VWAPs) have been working like a charm.

The Anchored VWAPfrom the March 2020 was tested and successfully held. Now tech is ripping into the AVWAP from the big swing high at the end of 2021.

That level — at 257 — will line up with the key volume shelf and prior pivot levels that could easily come into play.

Tech has been a drag on this market for months, so if these upside levels find hard selling, it can easily put a damper on further upside.

To the downside, we have 342. This is the prior volume shelf and key pivots from the Jan pullback and the April 2021 highs.

If that holds, look for 371.

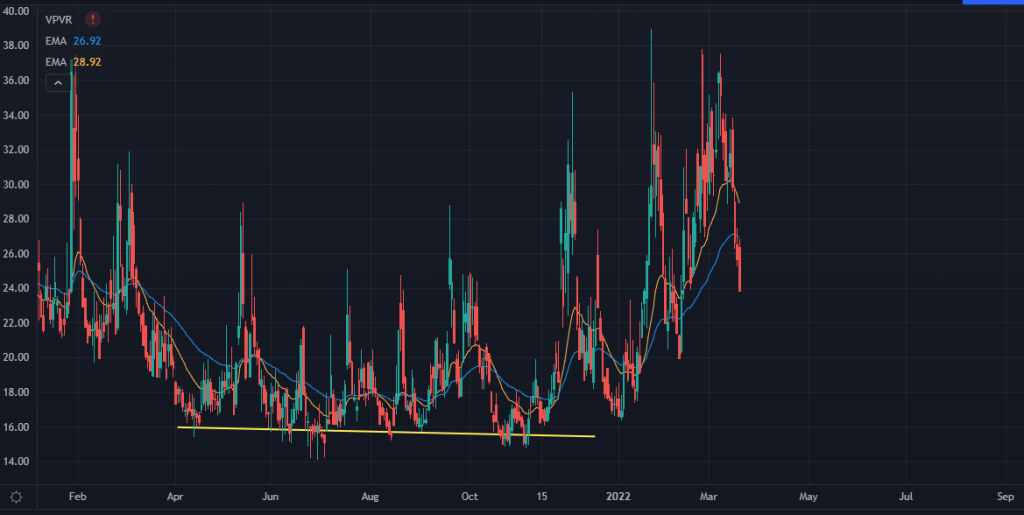

IWM

The upside level on the Russell is as clear as day. On our Roadmap, we have:

The VWAP from the all-time highs…

The VWAP from the Sep 2020 lows…

And the huge prior support level that could act as resistance.

Odds are we’ll find some sellers there, just because traders will be taking profits. But if the selling is aggressive and sustained, the IWM could easily head back to the middle of the most recent trading range.

Yet if we test it and have a small pullback but no downside followthrough…

We can easily get a move back above it.

It’s possible that overeager shorts will use that level, and we will need to stop out on the next push higher. The 217-218 level into that stop run would be a much easier level to play.

VIX/VWIX

Last week, something interesting happened:

Barclays, VXX’s custodian, stopped issuing new units of the ETN.

We don’t know the why behind it…

But I bet because market liquidity is so bad, all the new units they were pumping out were having outsized effects on the volatility market…

So they got a tap on the shoulder and were told to stop.

The volatility market started to sell off before the Fed meeting, reinforcing my thesis. It’s entirely possible, given the current liquidity regime in the market, that suspending VXX issuance helped add fuel to our current bear market rally.

There’s also the talk of “vanna flows,” an options mechanic that can drive equity prices.

As implied volatility falls in the options market, dealers and market makers are forced to buy the market as they end up more net short. If market liquidity is trash — and it is — we could see upside price movement.

Combine that with actual risk premium coming out of the market post-Fed…

And we had an absolute ripper this week as the vol complex got crushed.

Well, that’s it for this week’s Market Primer.

Before you go, though:

Watch this free training to learn more about the Market Roadmap I use in each Market Primer.