I’m watching a change in character in the markets as oil looks to stage a breakout.

For a year, the Fed has been trying to beat the tar out of commodity prices in an attempt to tamp down inflation.

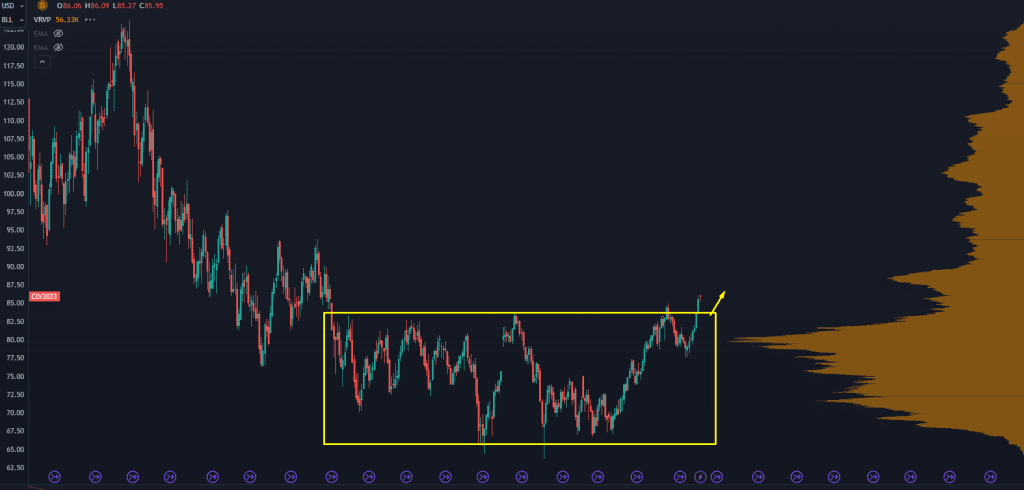

But energy markets have been stubborn. Take a look:

Oil’s Big Breakout Is Our Newest Opportunity

See that blue line? That’s the anchored volume weighted average price (or AVWAP for us trading nerds) from the 2020 lows in crude, when we went down to -$40 a barrel.

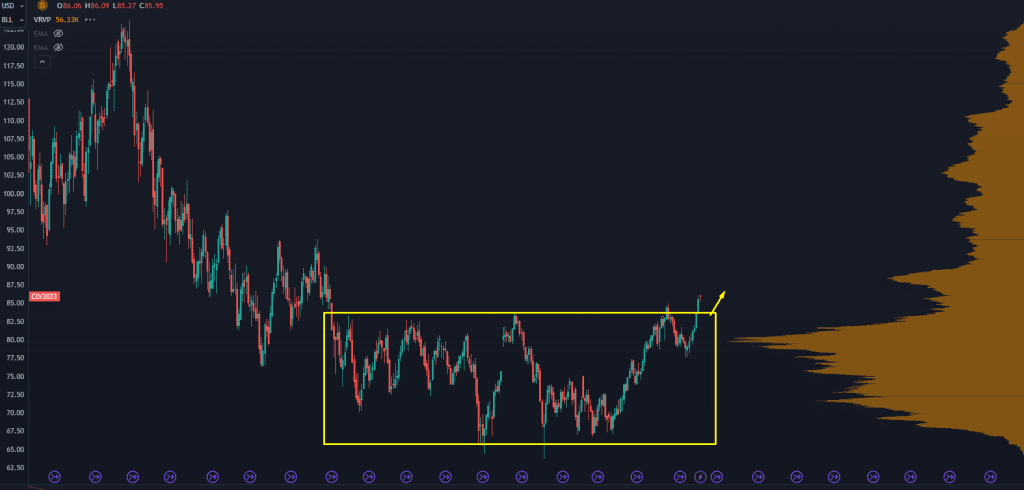

Oil’s Big Breakout Is Our Newest Opportunity

We’re now 10 months into a tight trading range, and we finished the week at the highs with a push outside of that range:

Oil’s Big Breakout Is Our Newest Opportunity

One more thing to notice: The point of control (POC) that has developed right around $80.

That’s where the majority of trade has occurred, and it’s where most institutional positioning sits.

If the big money has a basis around $80, and the market breaks out from $80, then institutional money is fat and happy… and has zero reason to sell.

That’s how you get a fast push higher into the energy markets…

And we’re ready for it with our newest setup.

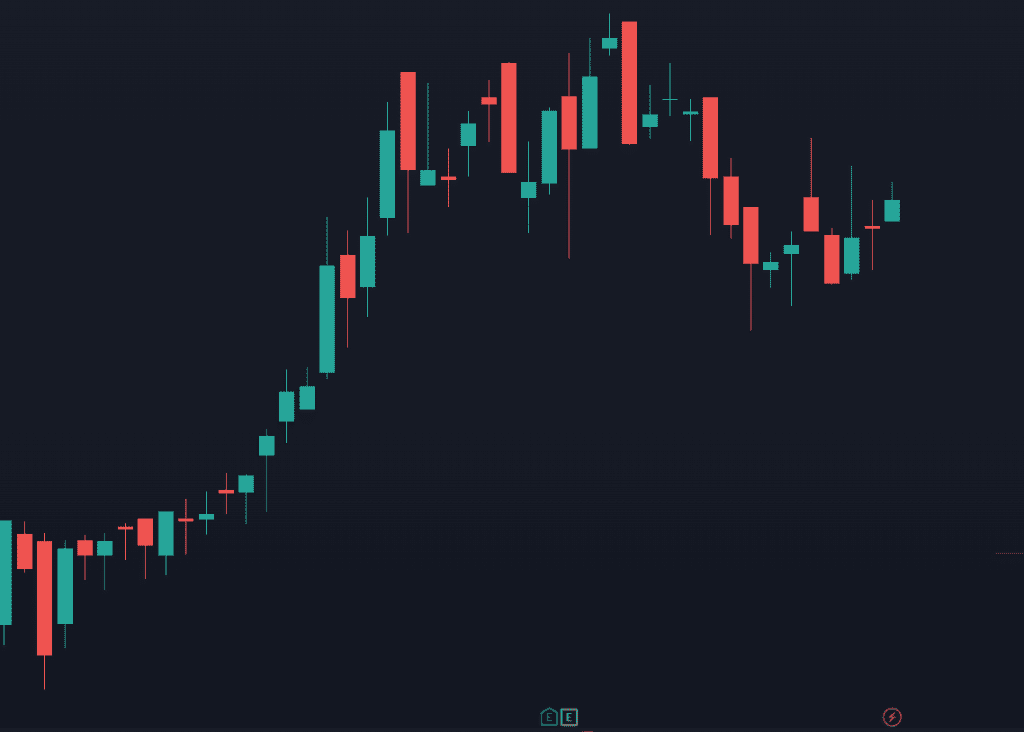

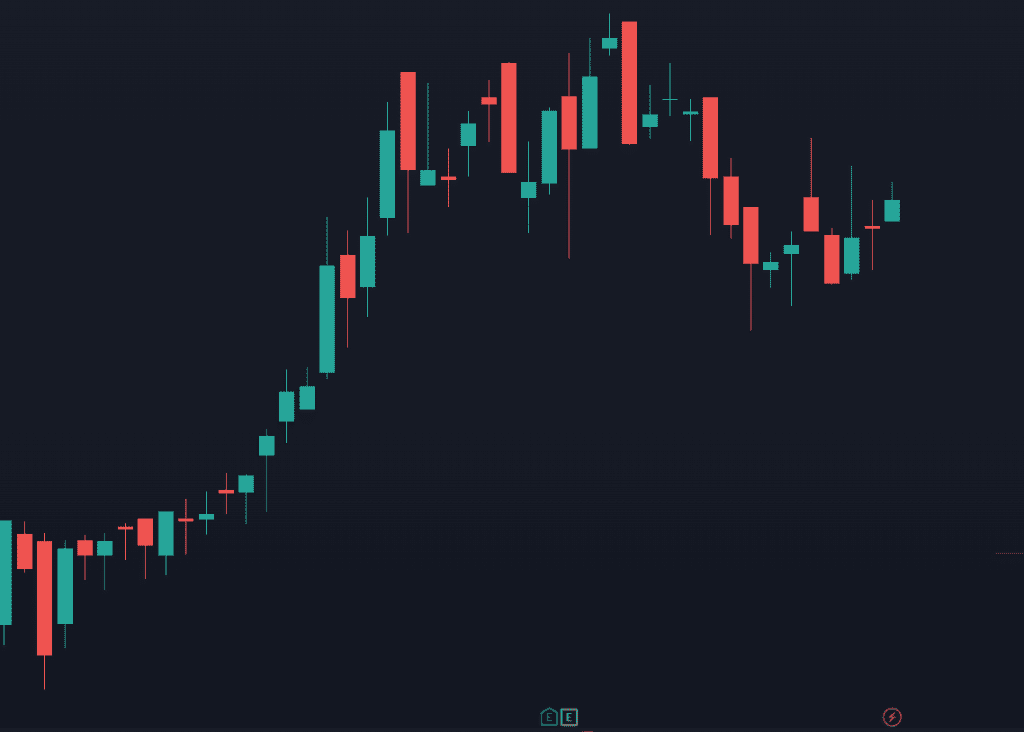

Picture Perfect Setup on This Oil Breakout Play

I just sent my paid readers a prime setup on the back of this oil breakout.

Take a look:

Chart

This is a recent IPO that was listed at the end of June…

And one particular board member just dropped nearly $100k on the stock AFTER it rallied following the IPO.

Now, normally there isn’t much insider action right after an IPO.

That’s because corporate insiders get share allocations as part of their compensation package, so they will be waiting for post-lockup to start selling shares and getting liquid.

So the fact that this board member is BUYING speaks volumes.

Remember: “When an insider buys at highs, it’s gonna fly”…

And I’ve got a very strong feeling about this one.

Original Post Can be Found HERE