With the kickoff of the largest European war in decades…

It seems everyone’s become an armchair expert on the conflict.

These are the same experts who have claimed to be experts on evolving pandemics, inflation, and supply chains… and they don’t exactly have the best track record.

Heck, I have some very well-connected friends plugged into various parts of the intel apparatus…

And they have enough insight to simply say “We don’t know.”

Here’s a quote from one of my friends in high places:

“The Intel community likes to think they know which side the coin will flip. Feels more like a roulette wheel – we’ve placed some bets and now just watch the ball spin around.”

That’s what it feels like, doesn’t it? The outcome is very uncertain, and the last thing we want to do is land on 00…

Because 00 is nuclear.

It’s super low odds, but those odds are a lot higher than they were a few months ago.

Here’s why I’m saying all this:

I will never try to be an expert in a domain I don’t know.

So while I will try my best to ask the right questions and always reach out to my expert network for the best answers…

… I will stay in my lane, which is trading, understanding how markets are structured, and using our Roadmap to analyze what’s going on right now.

(By the way, if you want to learn more about this Roadmap, check out this free training.)

This leads us into the futures markets.

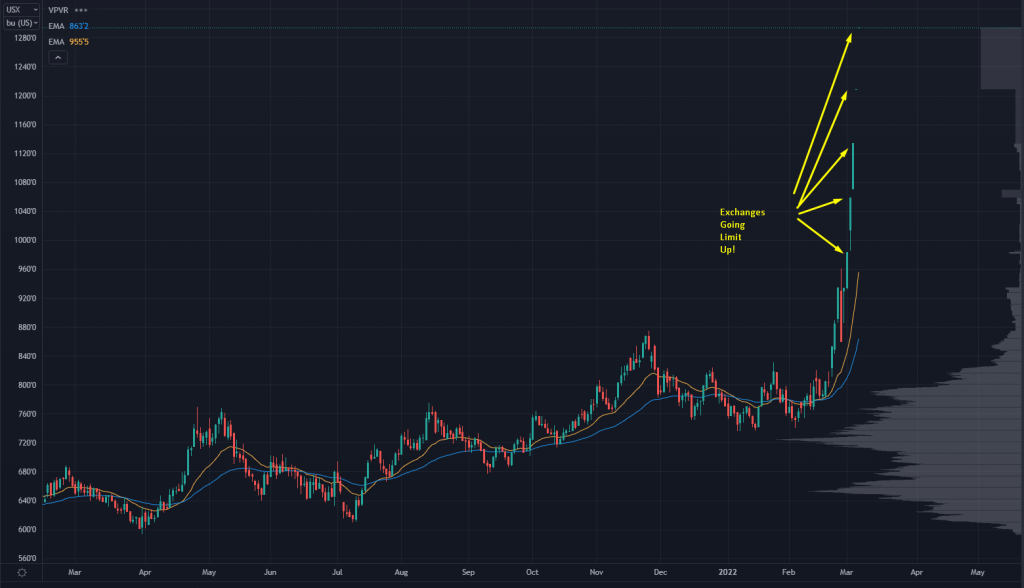

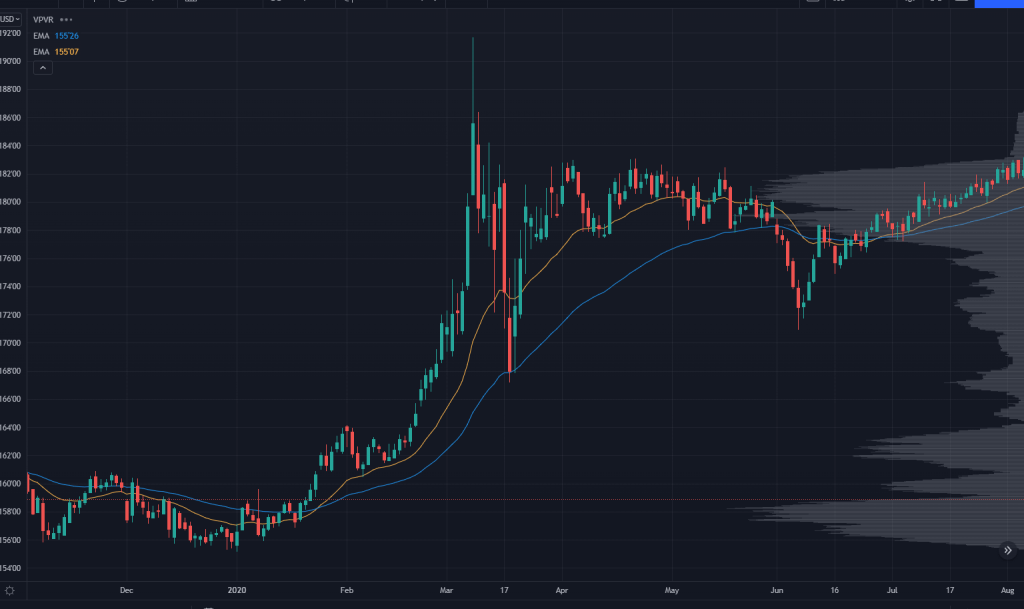

Here’s a chart of wheat futures:

Holy Rip, Batman!

We’ve got multiple days in a row where the exchange has gone limit up.

On Friday, the contract saw zero price action because the squeeze was so incredibly strong.

And on Sunday… it was an immediate limit up — +7% in a single day.

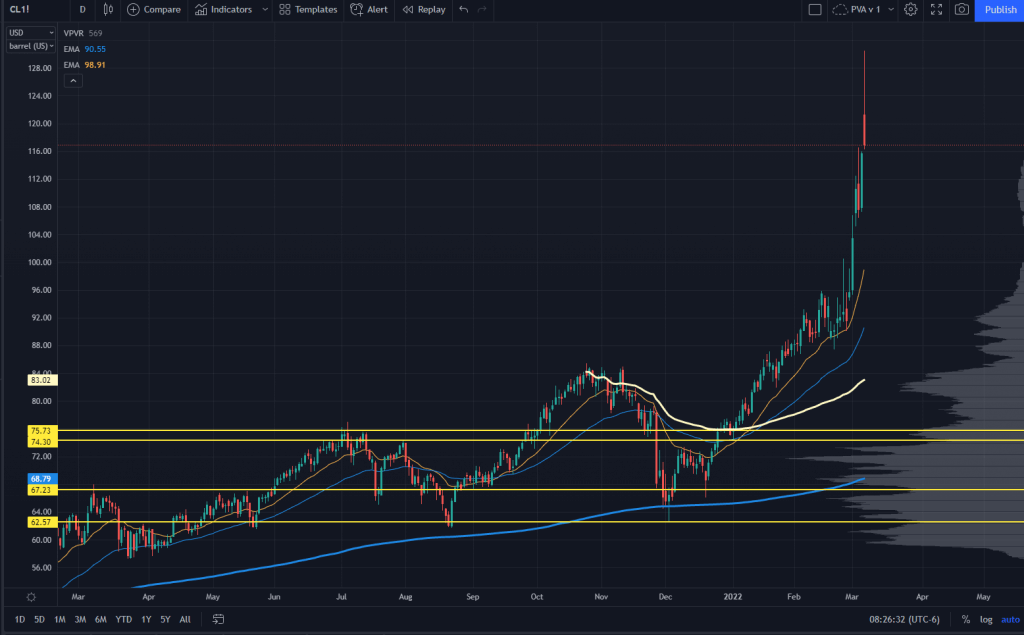

Crude oil did something similar:

Sunday night’s open saw a +$10 move, then another $10 push higher, then a hard reversal as some of the short inventory finally got cleared out.

This is no longer just about financial markets. The rip in commodities has very real-world effects that will carry over for a while.

(I mean, gas prices just hit their highest in HISTORY yesterday, for example.)

Yet here’s the question I’d like to ask…

How much of this move pertains to structural risk in the financial contracts?

It’s clear that Russia and Ukraine going offline drastically reduces the supply available for several commodities.

Not just oil and wheat — but nitrogen, fertilizer, zinc…

You name it, and its price is rising in response to Russia-Ukraine.

Since I’m the trading expert and not the foreign policy expert, we can start thinking about who is getting hit here.

Remember Meme Stocks?

Back in early 2021, I didn’t get much sleep for a 2-week period.

The Gamestop (GME) and AMC move had just kicked off, leading to massive squeezes all over the place.

You had moves in NOK, BB, TLRY…

Heck, you even had a squeeze in Kroger (KR), the grocery chain.

At the time, I was simply buying max-strike weekly calls on these names.

Was I a believer in these stocks?

Nope. I simply knew that the markets were broken, and some participants were stuck on the other side of the trade.

Yes, there was a short squeeze. But there was more to it than that. Robinhood had to pull from a $3B credit line, and traders started to learn about how stocks cleared through the DTCC.

GME’s upside risk wasn’t because of the company itself, but the structure of the markets.

Keep that in mind as we pivot over to the futures market.

Know Your Commercials

Commodity markets do not behave like stock markets.

In stocks, 90% of participants are long-only, investing in individual companies.

Sure, there are traders, hedge funds, prop shops, and HFTs…

But on the whole, it’s massive institutions, like pension funds, who have to allocate billions of dollars into stocks.

Commodites don’t operate like that. It’s much more of a “two-way” trade.

That causes massive upside moves when someone gets caught on the wrong side of a trade.

We’ll get to that in a moment, but first, let’s think about how the futures market operates.

Say you’re a farmer, and it’s planting season.

If you’re in the US, you’ve got a pretty good idea of your potential crop yield, the cost to pull it out of the ground, your profit if you “lock in” a price in the futures market.

The farmer will then talk to their broker, and they’ll lock it in.

On the other side of the trade is someone who needs delivery on those futures. A large chain like McDonald’s, for example.

How about oil?

Say you’re an oil producer like Exxon or Cabot. You know how many barrels you’ll pull out of the ground and how much it’ll cost.

You lock in your price, and a buyer on the other side, like an airliner, does the same.

The players on both sides of the market are the “commercials,” and they are the whales in the market. They’re not speculating on the price of the futures market, but hedging against risk.

So far, so good? Let’s talk about when things break.

When Things Get Weird

Sometimes, the structure of the market breaks.

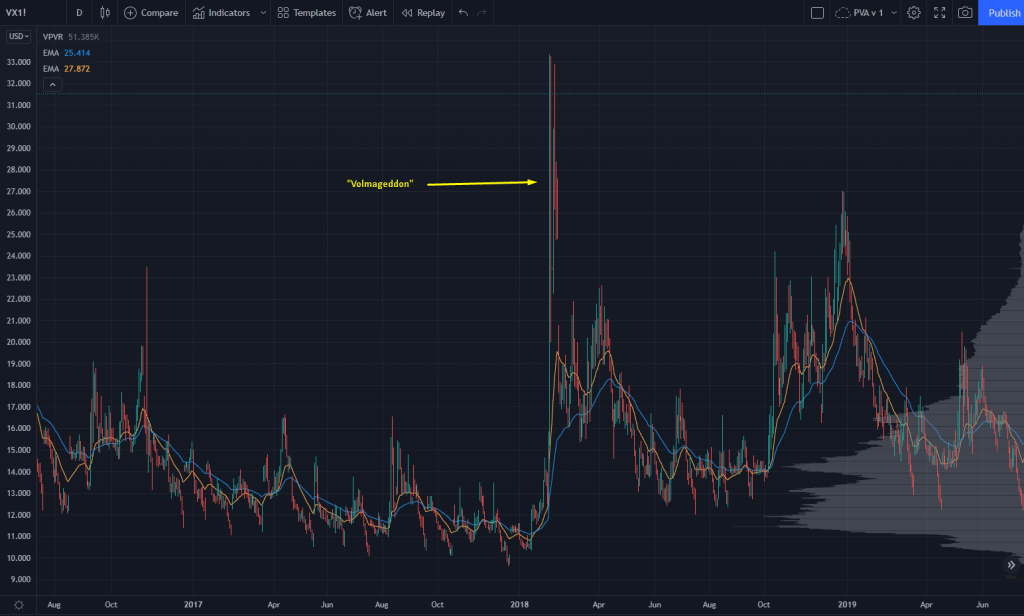

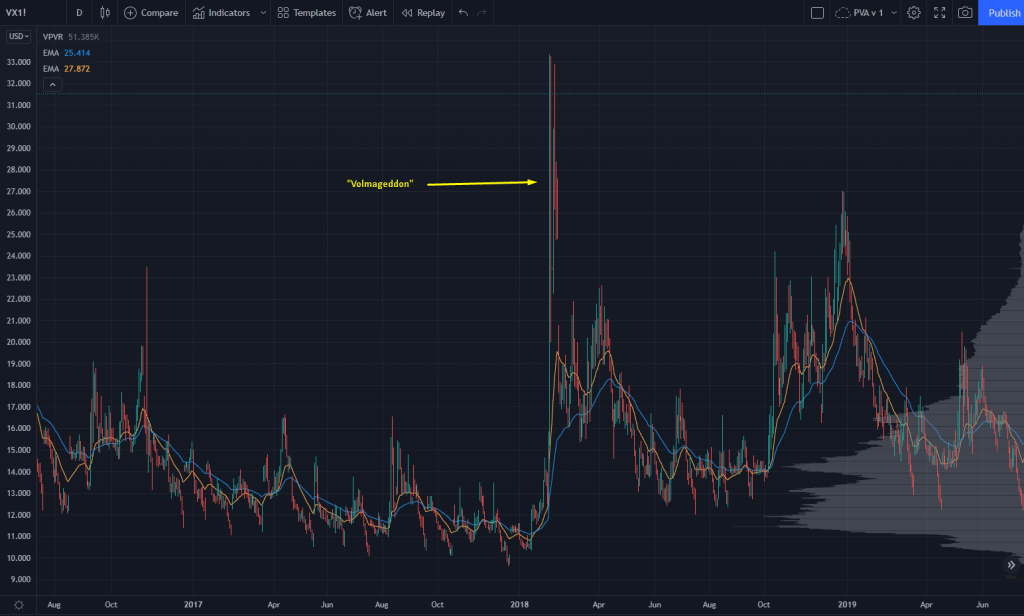

A good example is when VIX futures went crazy back in 2018:

An ETF called XIV shut down at that time, making that move even worse.

What about oil?

Back in 2020, there was a time when the delivery location for CL futures simply ran out of capacity.

The Cushing, OK facilities were filled to the brim with oil, and we saw the Crude futures contract go negative:

Both of these examples had little to do with overall supply and demand. Instead, it was structural risks in the market.

Both of these examples had little to do with overall supply and demand. Instead, it was structural risks in the market.

What About Now?

War in Europe + a down commodity supply is causing things to rip higher… but I think there’s a set of structural risks that are just coming into play.

Let’s go back to our oil example.

You have an oil supplier who sells some futures.

If that company goes bankrupt, they’re no longer operational. They won’t be able to meet delivery on their futures contract.

They will be forced to buy back their futures contract, similar to a margin call we’d see in a hedge fund.

This is called “counterparty risk.”

And it’s what I believe is driving the parabolic spike in the commodities market right now.

Let’s add one more spin on this…

Say you’re a Russian oil supplier, and you sell some oil futures.

And then war kicks off. And then sanctions hit. And then you no longer have access to the SWIFT banking system.

Long story short, you’re screwed.

The oil company can’t produce the oil needed to meet the delivery of the futures contract they have shorted.

And with the spike in oil futures, you’re going to take a huge loss on your short. Odds are, you have to put up more collateral in the form of a margin call.

Well, that’s kinda hard to do when you’re cut off from SWIFT…

And this is where things get VERY weird.

You have massive counterparty risk on the short futures side. With a war going on, the executives at these oil companies are more focused on staying alive and out of jail than they are on meeting an exchange requirement.

There’s a quote from John Paul Getty that rings true here:

“If you owe the bank $100, that’s your problem. If you owe the bank $100 million, that’s the bank’s problem.”

And this is where we could get a spillover with some of the systemic risks in the commodity markets.

I don’t have answers for this yet, but I would really like to know who is on the hook for this futures exposure if the counterparty risk continues to accelerate.

My best guess is some European banks will be in deep trouble here soon because they are the ones with exposure.

The Game Plan

When we see spikes in commodities, it’s almost like a huge move in the VIX.

Either we get hard reversion, or things can spin out of control.

If some of the structural risks are fixed in the near term, don’t be surprised of a massive selloff in the commodity complex.

Wheat, natural gas, corn, oil… all of them are running in lockstep right now, so they will all get hit, hard.

The best analogy I have is how the long bond traded in March 2020:

You had an upside crash…

Then a downside crash.

Those two moves were unprecedented… and the ZB futures market is one of the most liquid markets in the world!

The other side of this is the potential for cascade effects. If the counterparty risk in commodities accelerates, I think it could spill over into the banks.

Let’s take a look at some of the “usual suspects,” and I’ll start off with a meme:

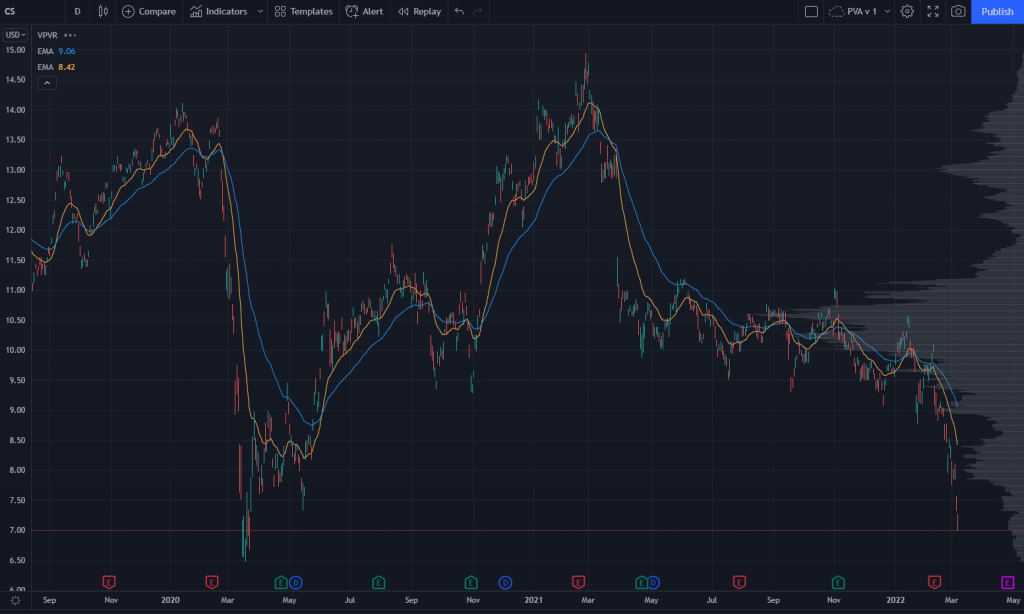

Here’s Deutsche Bank:

And here’s Credit Suisse:

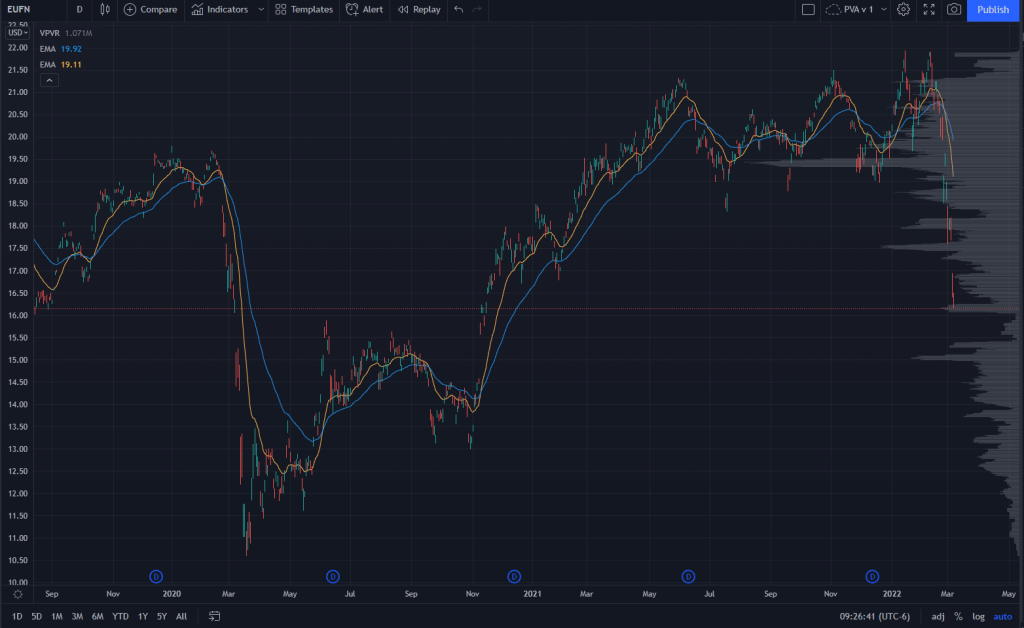

And here’s EUFN, an ETF that tracks European Banks:

If you’re trading the markets, you must pay attention to how this is playing out.

There are times you can ignore much of macro and just play individual names…

But given the potential for global contagion right now, keep an eye on these names to see if spillover will continue.

By the way:

If you arm yourself with our Market Roadmap, you’ll be far more prepared if the markets start getting weird.

Watch this free presentation to learn how to equip yourself with our Roadmap now.