At Precision Volume Alerts, one of our favorite tools for spotting key market levels is the Volume Weighted Average Price (VWAP).

VWAP looks at how a particular stock or other security has traded over a day. It then uses the day’s volume to tell us the average price traded.

Essentially, you add up the total number of dollars traded on every transaction (price * shares traded), then divide that by the total number of transactions.

(Of course, you don’t do this by hand — the trading software does it.)

Then, you can average VWAPs out across multiple days to see if the average market participant is winning or losing in a trade.

Finally: If you “anchor” the VWAP against key pivot levels, you gain hidden market information in the market retail traders aren’t watching…

But institutions absolutely will trade against.

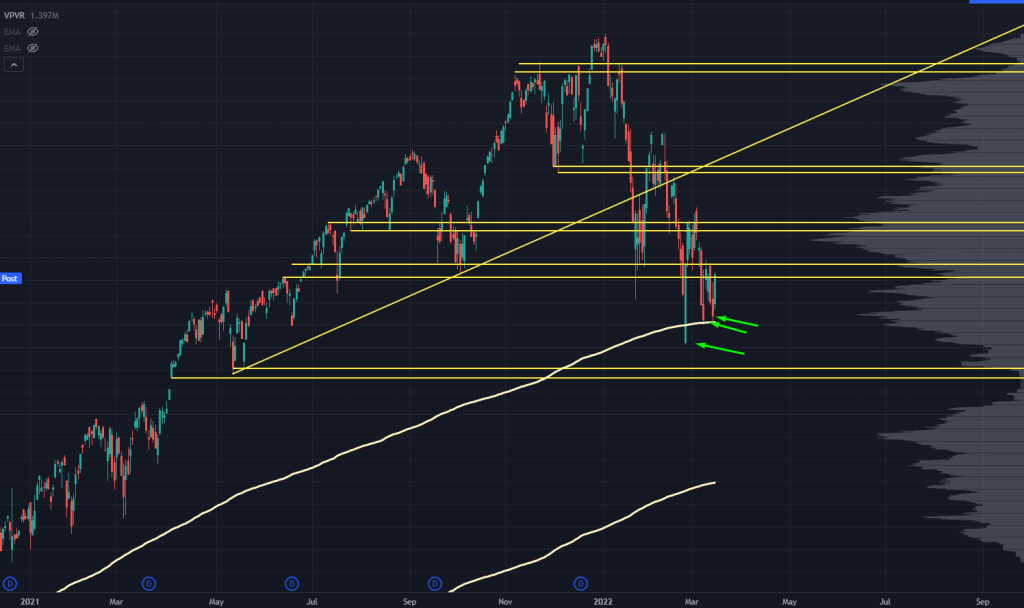

A good example is the Anchored Volume Weighted Average Price (AVWAP) from the September 2020 lows in SPY:

We’ve seen responsive buyers at that line with the green arrows the past two weeks…

And the longer it holds above, the higher the odds of a move to the upside.

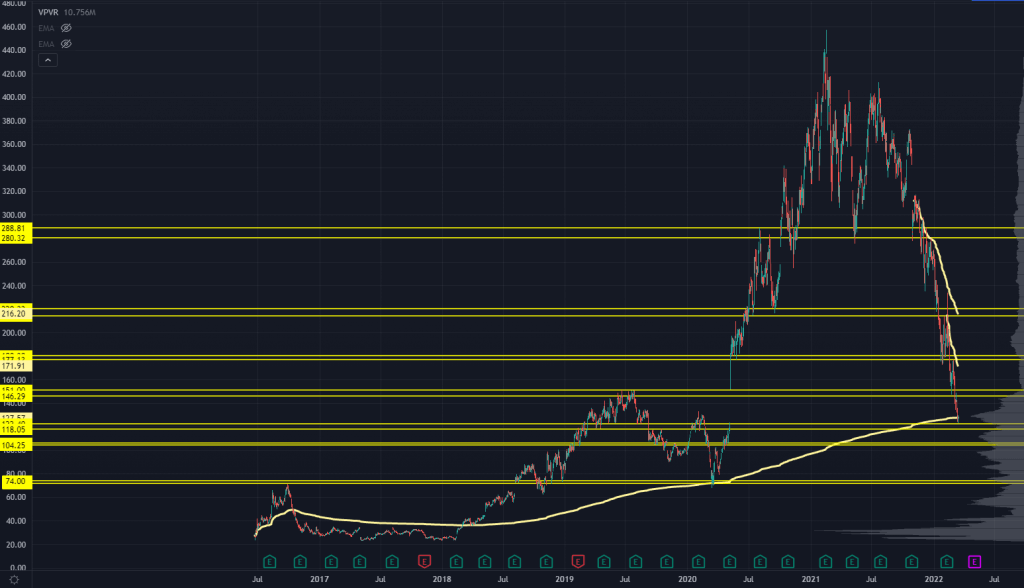

You can also see how Nasdaq futures are interacting with the AVWAP from the March 2020 lows:

Clearly, investors with serious size in the markets are watching these levels.

You can anchor your VWAPs against big levels…

But one I’d like to point out is the IPO VWAP.

Many tech stocks have seen massive corrections to the downside, and they are coming into their VWAPs from when they first started trading publicly.

Here’s an example on a stock newly added to the Precision Volume Alerts portfolio:

This is a tech stock that’s been cut by 70%.

It’s coming into a massive earnings gap fill, and it’s right at the AVWAP from its IPO price.

These long-term indicators are great for finding key turning points in these stocks.

We’ve picked out some cheap call options for this trade, and if we have a bear market rally, we could have an easy triple on our hands.

On the options side, many stocks like this have call options cheap enough to offer great risk/reward. Plenty of market participants are selling calls on these names to stem the bleeding.

If we see a rally, those calls will be the best way to play them.

Now, the VWAP is just one part of our Roadmap system. For an in-depth training on the Roadmap…

I’ll also explain how to join PVA and get the tech ticker I explained above (along with the rest of our portfolio and alerts).

Make sure you check out the presentation now.