Those watching the markets closely have noticed a shift in recent months.

Names like Netflix and Amazon have fallen while Procter & Gamble, Home Depot, and other blue chips have pushed higher.

The trend is clear – investors are moving out of growth stocks and into value.

And insiders are flooding into the deep discount opportunity in our next stock pick.

Get Access To This Ticker And 3 Others here.

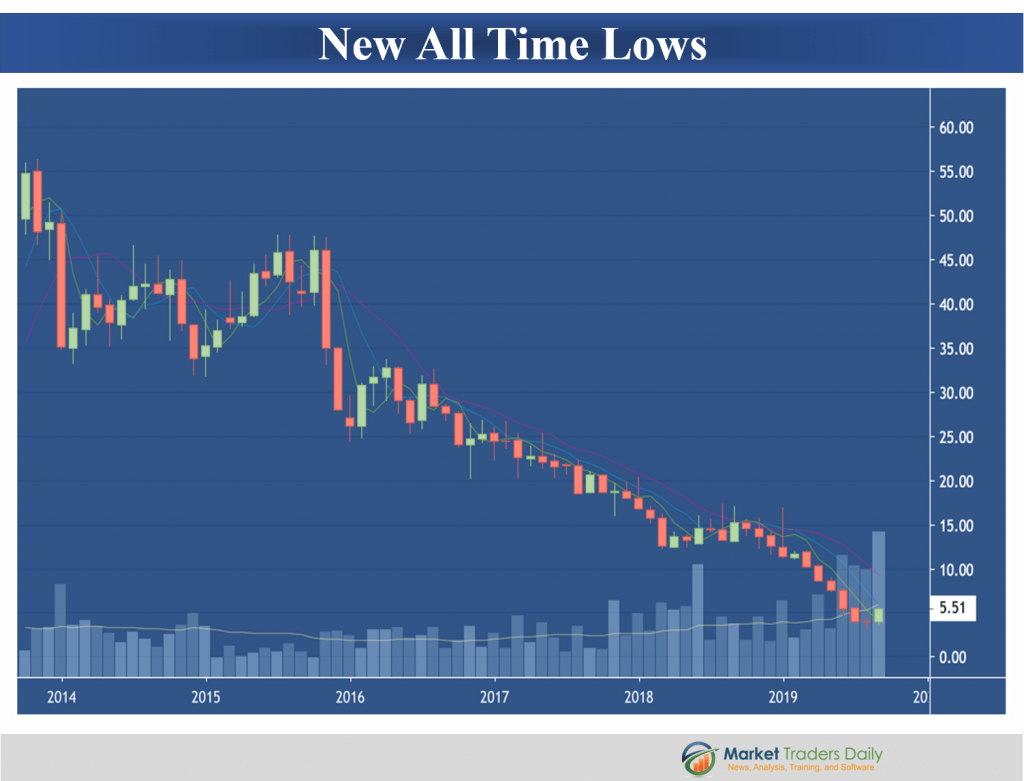

The once-dominant retailer that is on our radar today has been pummeled in recent years.

After reaching a high of $57 in 2013, it made a new all-time low last month at just $3.15.

But many believe the stock is oversold.

But many believe the stock is oversold.

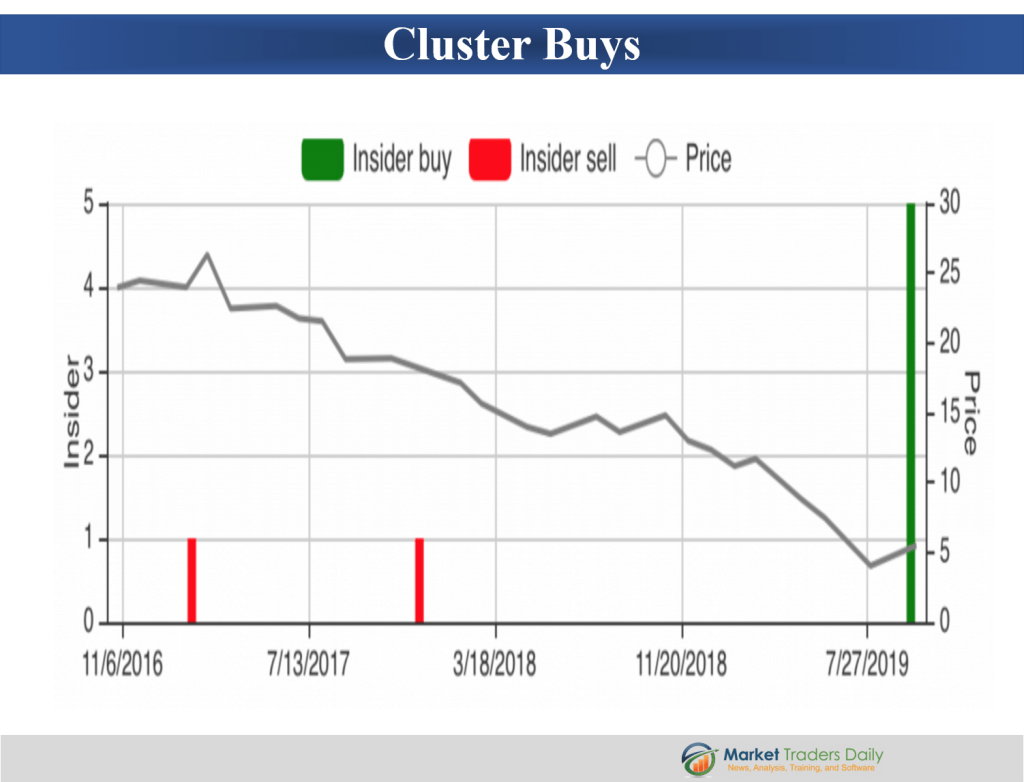

And no one is more convinced of that fact than corporate insiders.

Four directors bought five times this month for a combined investment of almost half a million dollars.

This cluster buy is even more significant because of how rarely executives in this company buy stock.

These are the first purchases by anyone at the company in more than three years.

Make no mistake – this is not a growth stock.

Revenue has been flat for several years and is not expected to increase any time soon.

But the stock has been oversold.

It’s simply too cheap.

The company is expected to earn $1.03/share next year, giving it a price/earnings ratio of just 5.

And insiders are calling the bottom.

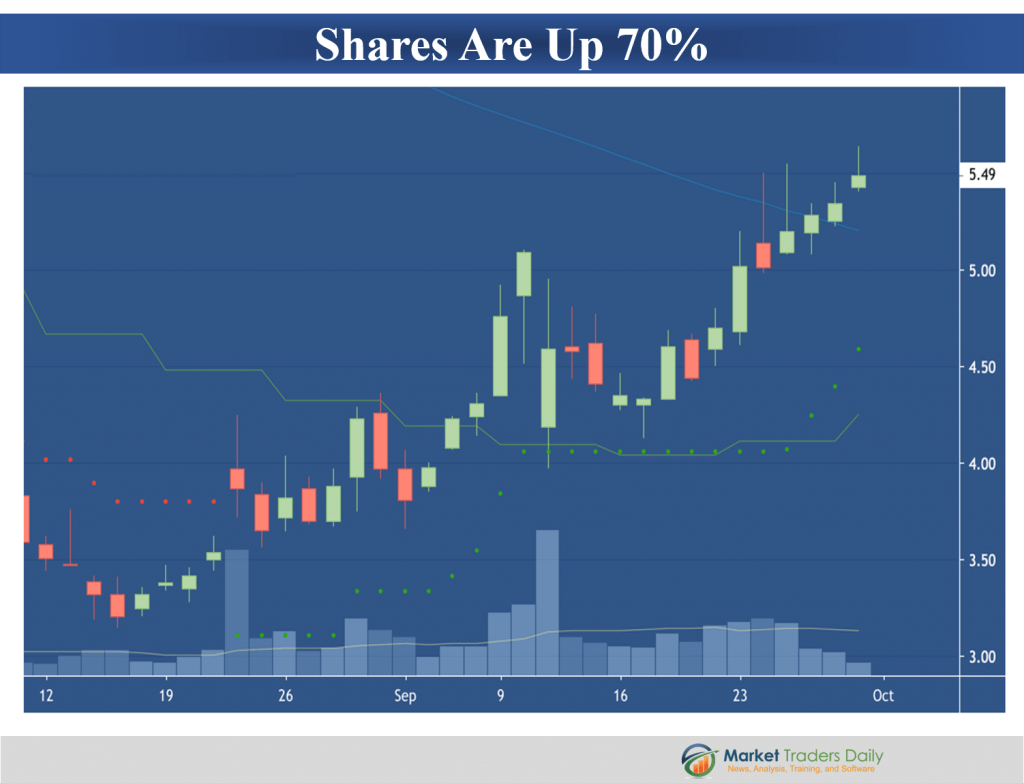

Shares are up 70% in the last three weeks and steadily pushing higher.

We have issues an alert to our Insider Report users. If you are not a member and would like to…

Gain access to this stock and 3 others you can learn more here.