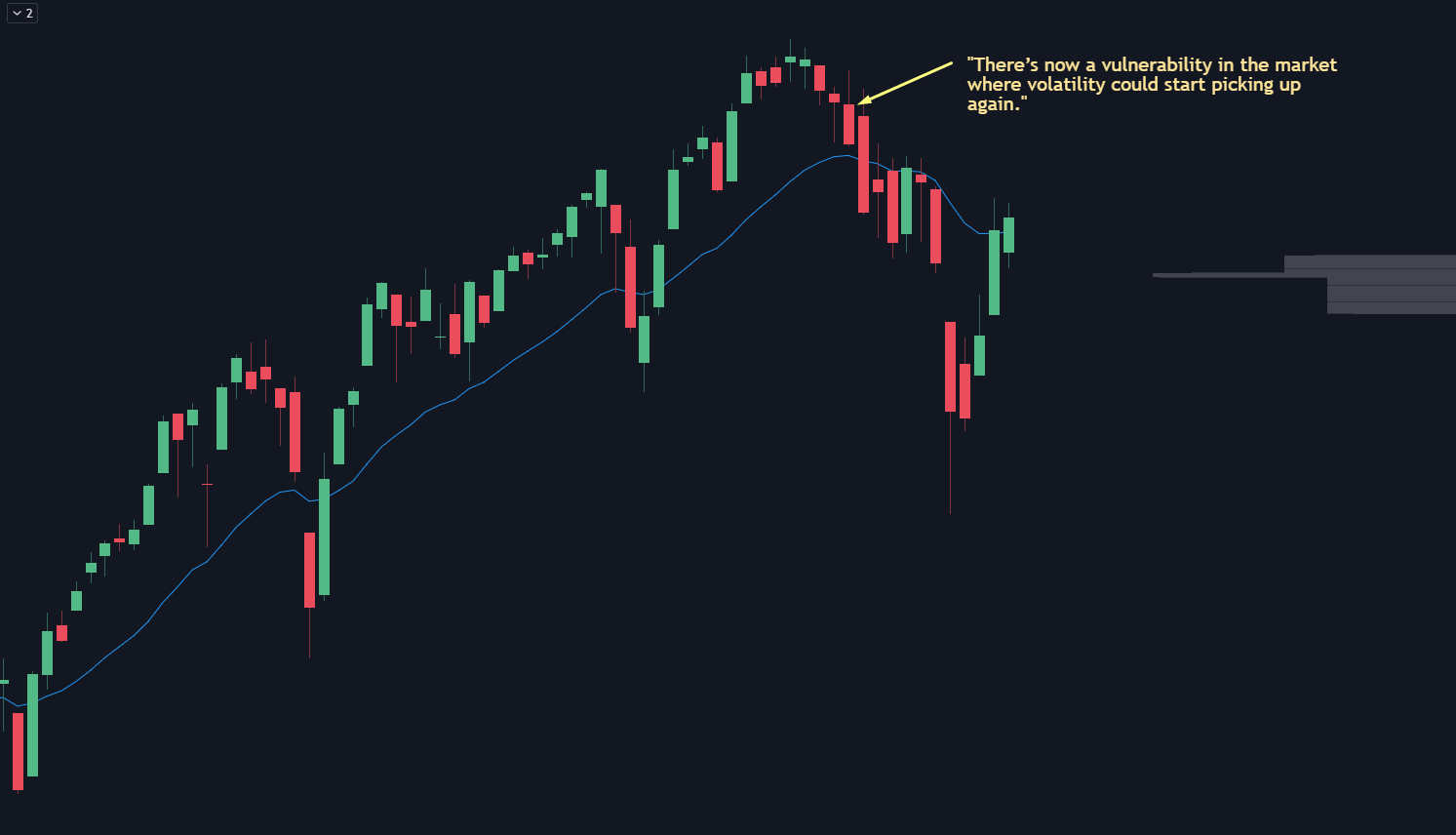

The markets had a nasty reset last Monday. The news wasn’t important — it was that there were too many investors underhedged, and they all panicked at the same time.

If you read my last note, you would have been prepared for it. I wrote:

I think this round we could easily see the trade break. Too many are conditioned for that shallow dip, and this could be the time where traders are punished.

As we head into the Fall, make sure that your positions can survive a “stress test.”

A short time later, the S&P had its first 5% correction in months.

Now we had those same investors pile back into hedges, which put a fast floor in the markets.

I think there was enough damage done in a few spots for sellers to show up when they get back to breakeven…

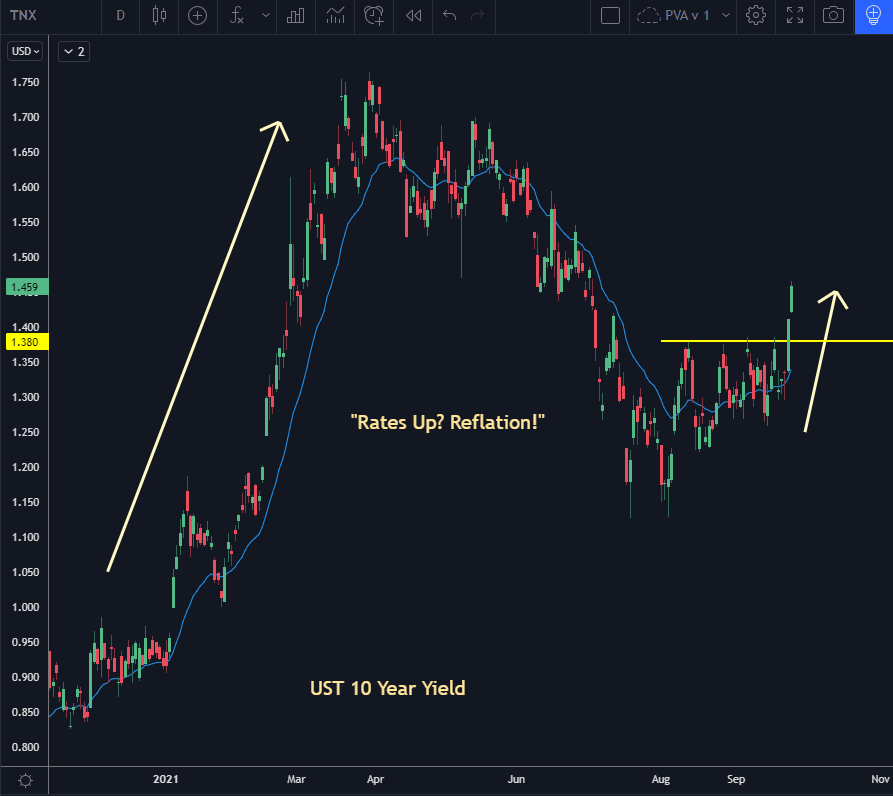

Yet there are some “hot pockets” in this market that you absolutely should pay attention to… and it can all go back to how bonds traded last week.

The Reflation Trade

Last week’s headlines were dominated by the Fed meeting and when they were going to taper. You also have the narrative surrounding the US infrastructure bill that’s been simmering in the bond markets for a while.

With those two stories in mind, look at the clean breakout in treasuries after going nowhere for months.

When rates are rising, it helps a few sectors more than others. Commodity names and banks are the themes that you can focus on during these moves, as well as outperformance in smallcaps.

We’ve already covered the banks last week, and you can watch the video here.

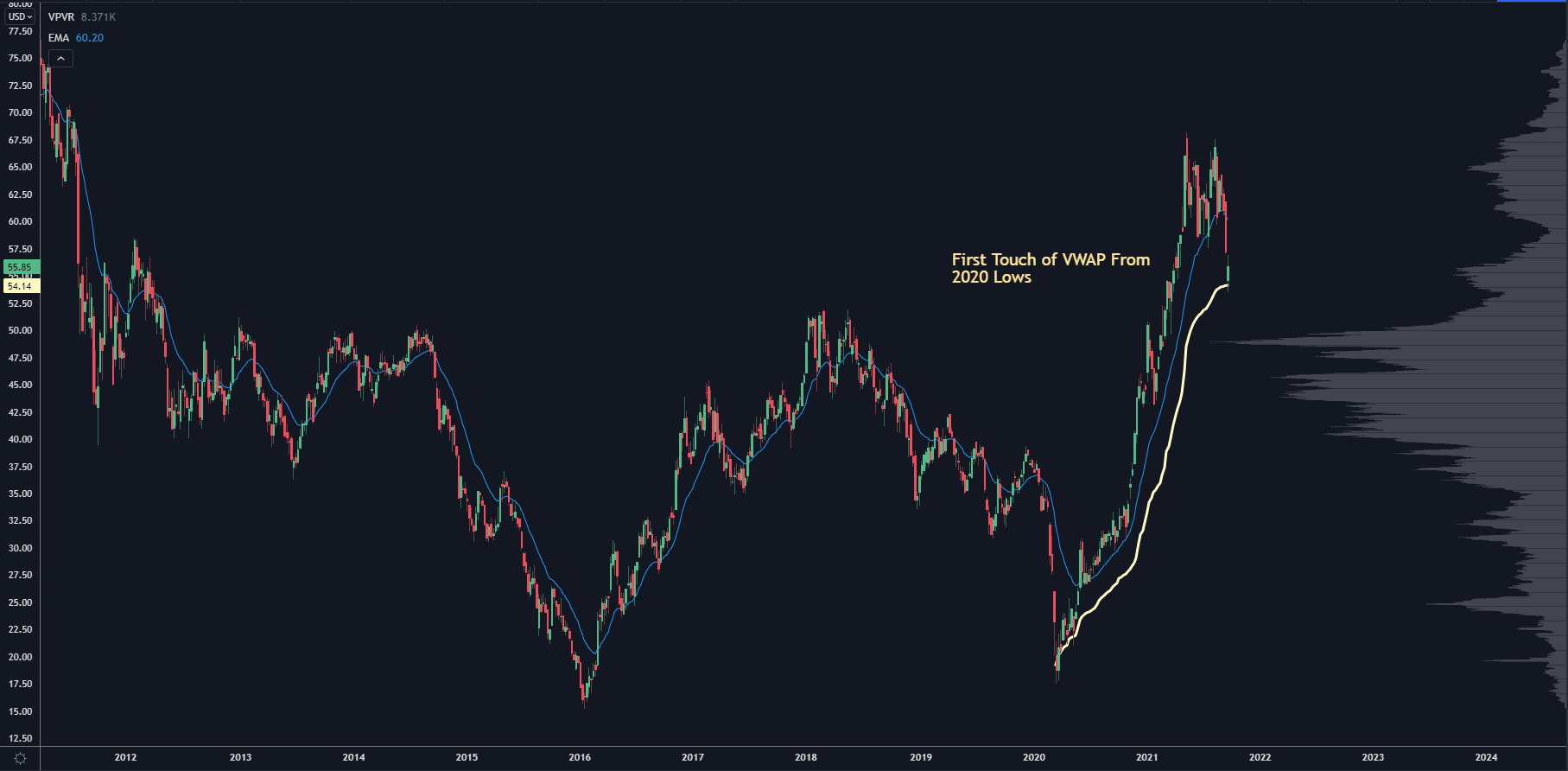

Yet we can look at a different sector right now: Steel.

Checking Out The Steel Index

SLX is the ETF you should watch to track steels.