Another FOMC meeting in the books.

Can you guess what happened?

The central bankers announced the taper we all knew was coming…

But they insisted inflation is still transitory and held off on any rate hikes.

Here’s the funny (and terrifying) thing:

The data has gotten so bad, Powell subtly moved the goalposts on what “transitory” means.

Here’s what he said:

“Transitory is a word that people have had different understandings of. For some, it carries a sense of ‘short-lived,’ and that there’s a real-time component, measured in months.”

“Different understandings.”

Scary stuff. When the Fed tries to change definitions to fit a narrative or insists that there isn’t a hard definition at all, you should be worried.

It’s kind of like when they said the subprime crisis was “contained.”

We all know how that went.

Now, I can understand why they’re doing what they’re doing.

The Fed is trying not to have a repeat of October-December 2018.

Back then, they were incredibly aggressive with tapers and interest rate adjustments… and that led to a massive move to the downside.

The problem is that inflationary signals continue to pop up. In fact, other central banks are trying to get ahead of it.

For instance, the Bank of Canada recently pulled forward its rate-hike forecast.

Even more: the Czech National Bank just hiked its key rate a giant 2.75%.

All signs point to more inflation.

But you can potentially stay ahead of it with the right market plays.

I’ve already talked about using solar stocks as a proxy for coal plays…

And today, I want to look at another set of plays:

Base metals.

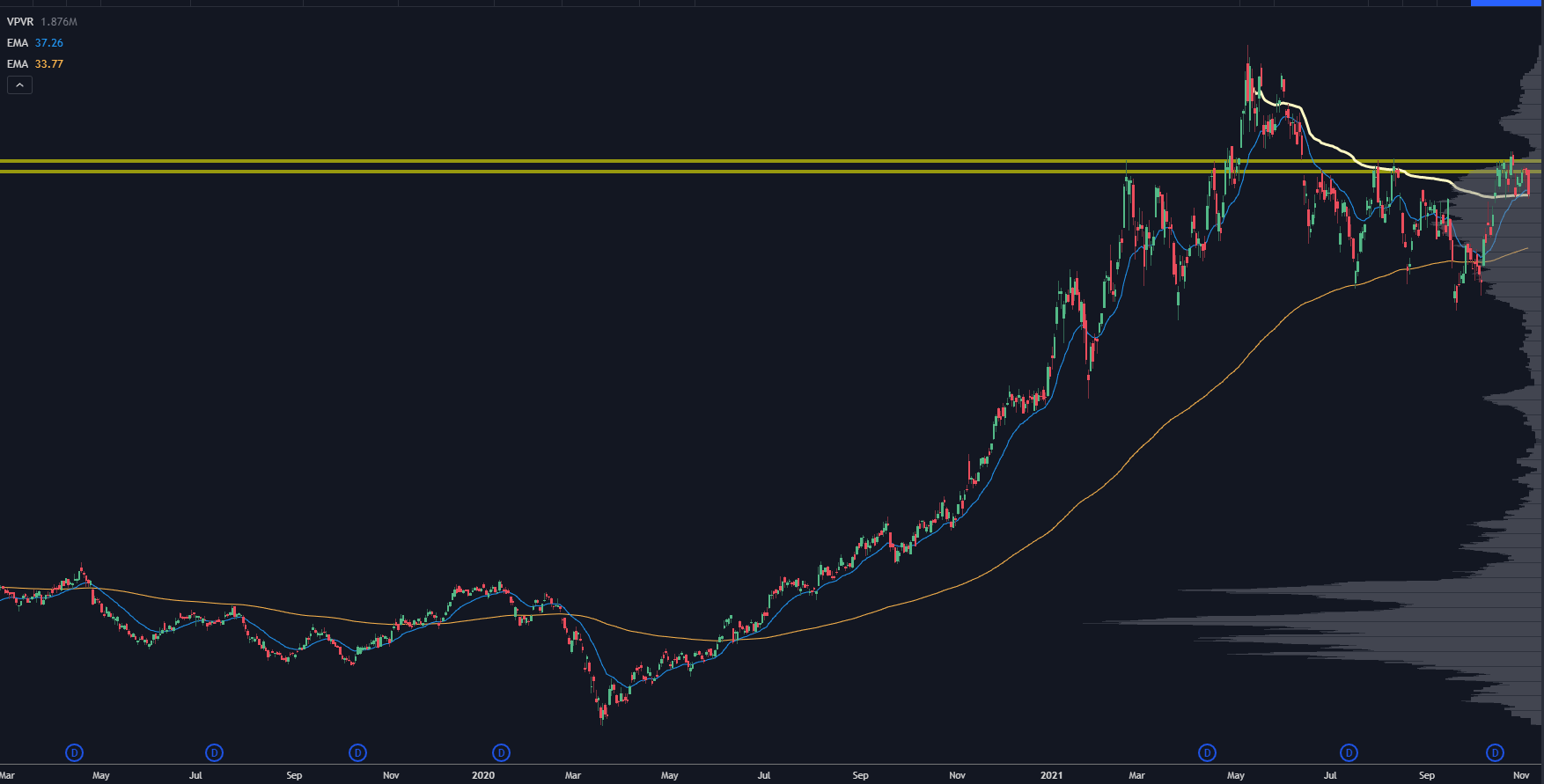

A lot of these have been on monster runs. Take a look at FCX, a copper play that ran over 850% off March 2020’s lows:

Since FCX is a copper play, it benefits when copper futures are running hot.

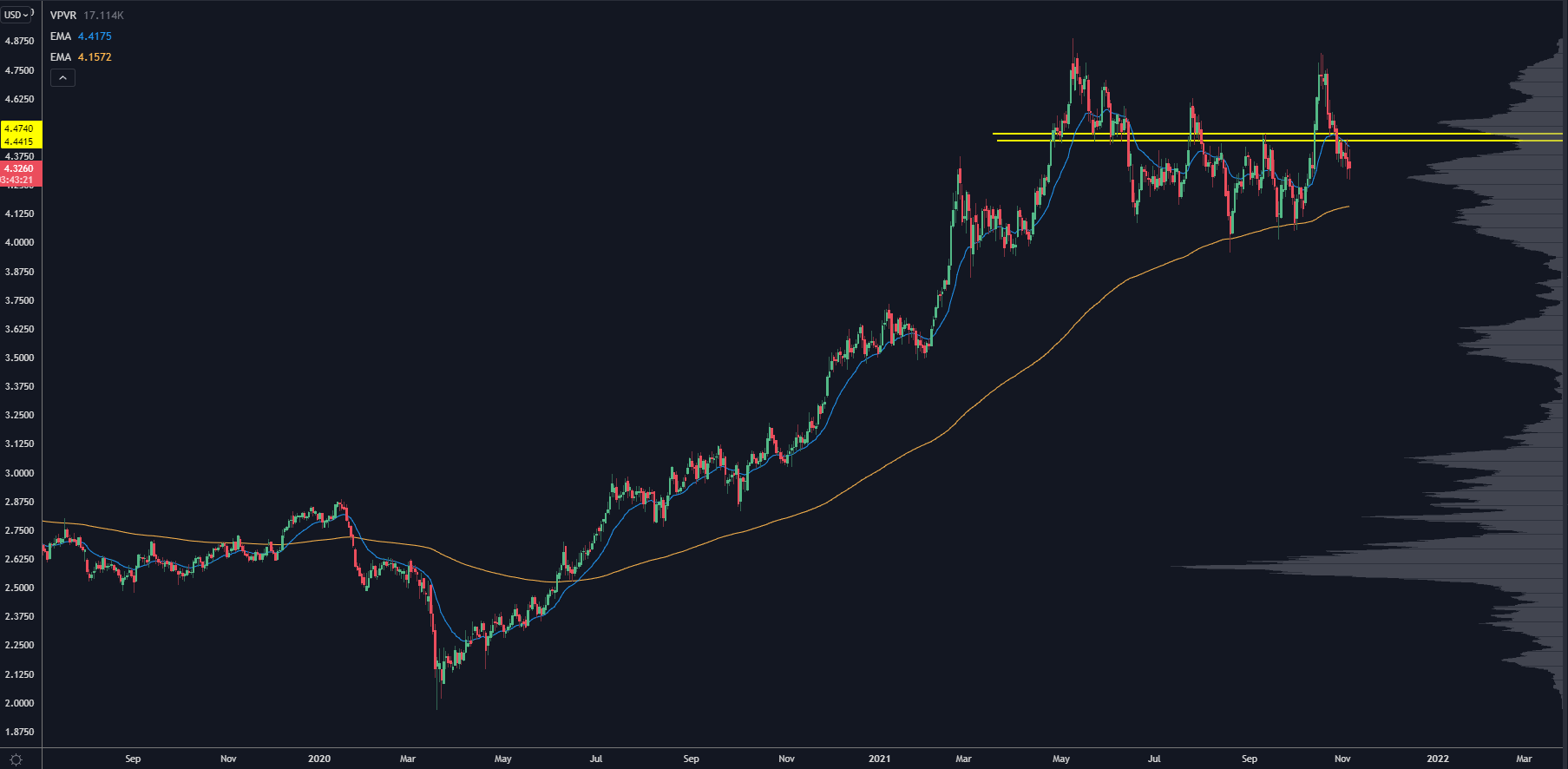

Here’s a look at HG (copper) futures:

The current price action is absolutely not transitory.

This industrial metal has rallied, and it’s holding its levels. That spells trouble for the Fed…

And that’s where we can find profits.

Many of these base metals plays could continue to move higher as they bring more capacity online to increase earnings.

Higher metal prices = better margins for the companies.

However, they can be volatile, so you can get some amazing opportunities in these stocks.

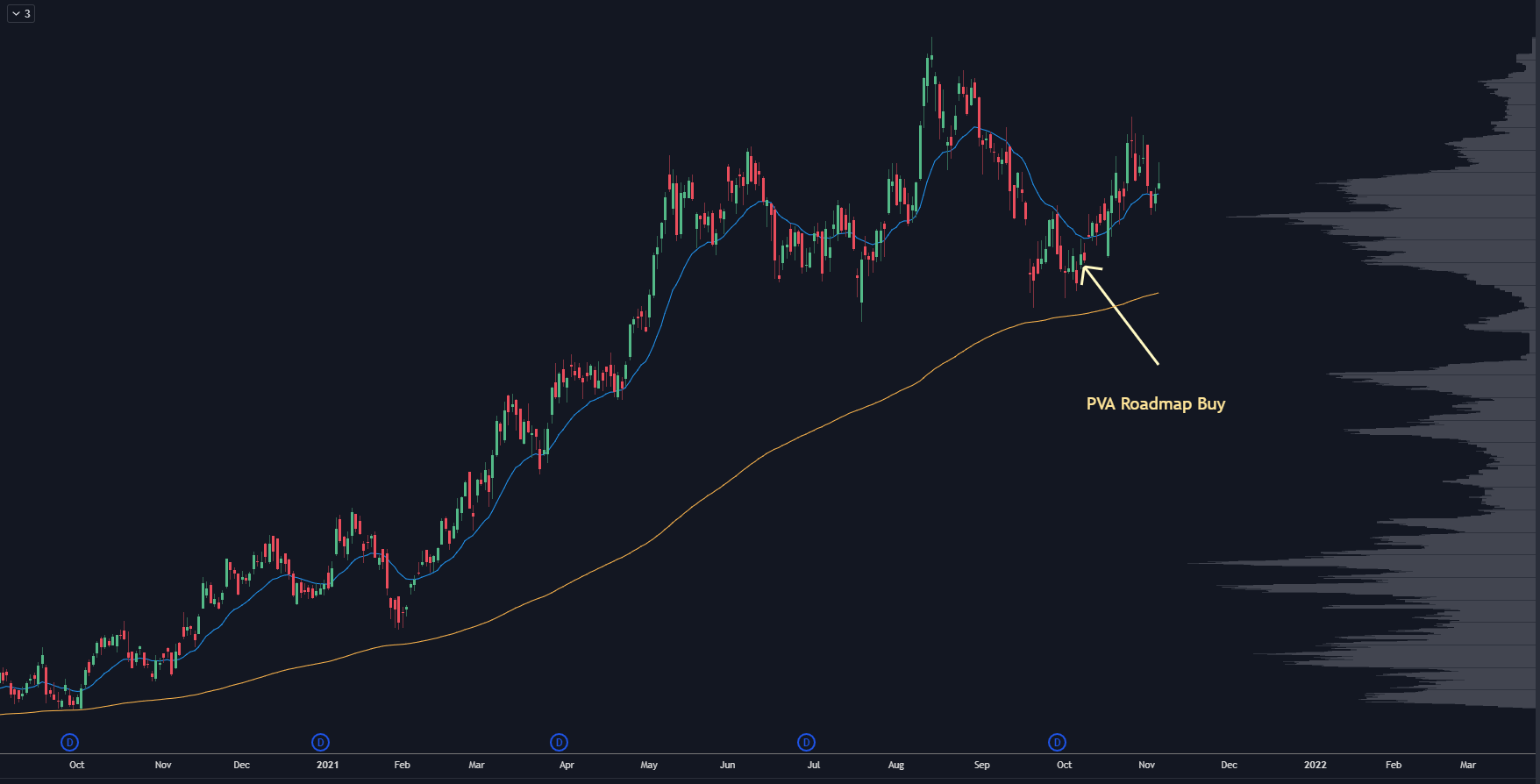

Take STLD, a steel company.

After having a run of nearly 400% off the lows from 2020, this stock had a hard reset into a key level we found on our roadmap.

Sure enough, as soon as the stock hit our buy point, we found buyers ready to step up.

We closed out some of our call options at a 76% gain, and they traded up as much as 182%.

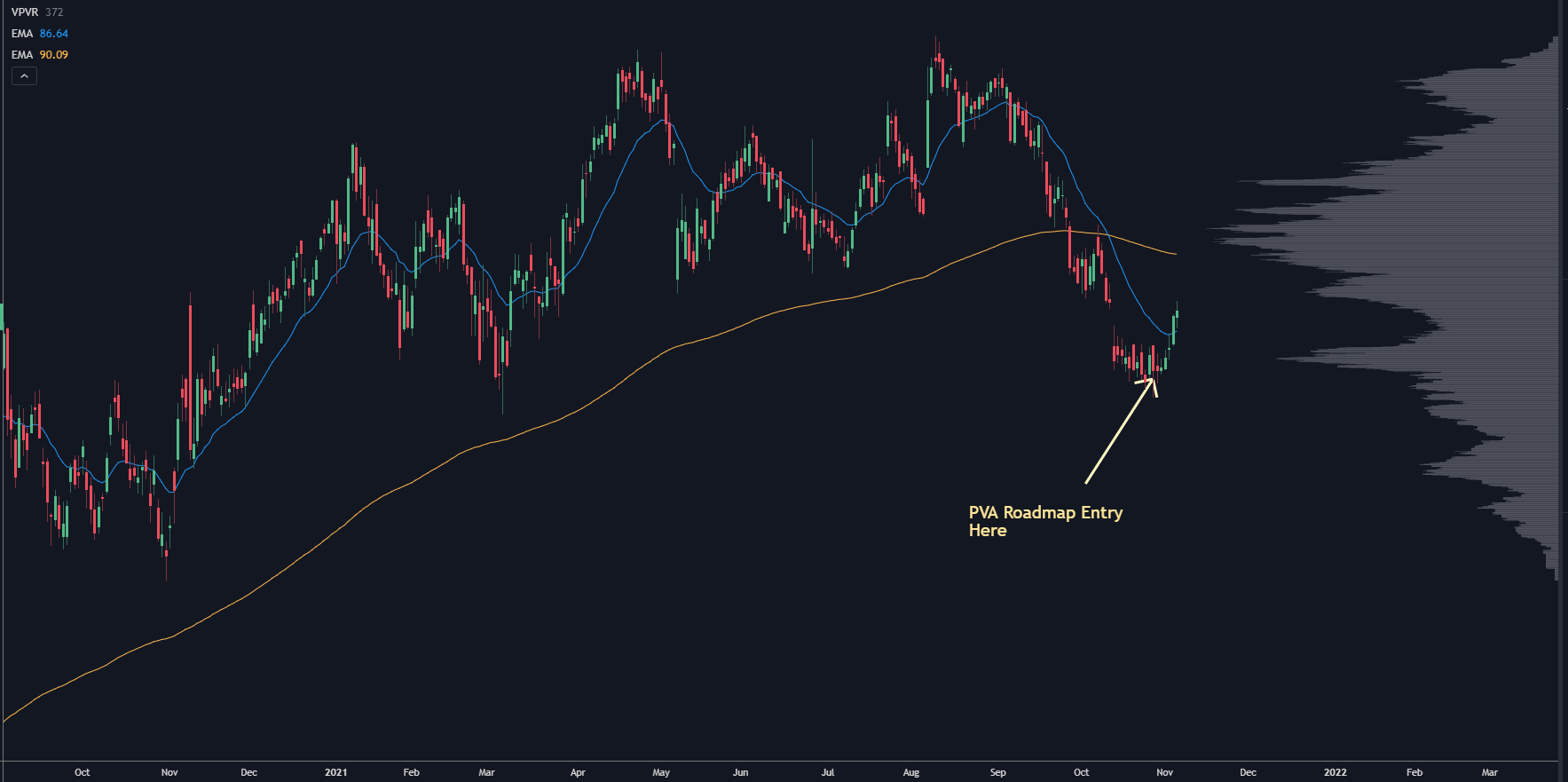

You can also use base metals to find volatility in stocks that buy those metals from the manufacturers.

For instance, MNST (the company that makes Monster energy drinks). Supply chain issues are squeezing its margins.

To most investors, this sounds ugly…

But our roadmap prepared us to play the stock into key levels:

On this trade, our call options are currently up over 66%…

And if we see the stock go back to the middle of the range, then we will see a move of 137%.

It’s all because of our roadmap.

So if you’re concerned about “non-transitory” inflation, then you must keep the base metals stocks on your screen and know which companies can see hard selloffs due to input costs.

Or, we can do it all for you.