Over the past few months, we’ve discussed the “empty shelves” economy and how supply chain constraints can lead to shortages on the shelves.

Like many economic forces, its effects aren’t evenly distributed.

The everyday consumer, along with mom and pop stores, aren’t really prepared because they don’t have the tools or the means to fight it.

Meanwhile, mega-corporations like Amazon and Walmart are throwing tons of resources at the problem because they have those resources.

For instance, Amazon is building out a parallel supply chain entirely under their control. By doing so, they can insulate themselves from another global crisis, in theory.

They’re even using different-sized shipping containers that no other company can use, according to an article from CNBC I read a couple weeks ago.

Yet, even the biggest players aren’t sheltered from the supply chain chaos.

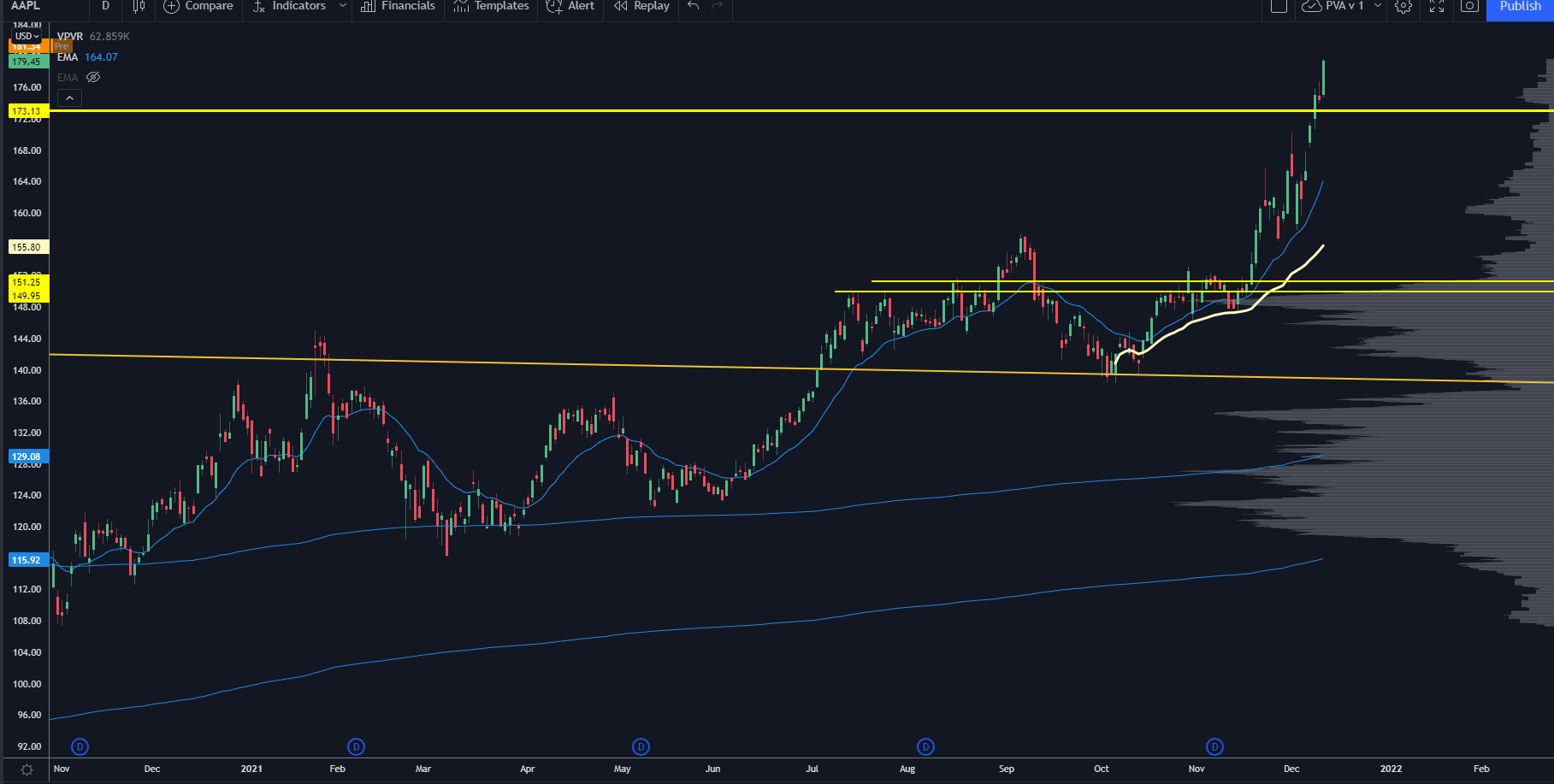

Take AAPL, for example.

For the first time in a decade, they halted iPhone manufacturing because they didn’t have enough chips to make the phones.

That’s right…

The most powerful company on the planet — and nearly the first to reach a $3 trillion market cap — can’t keep the trains on time.

With that kind of headline, you’d expect AAPL to go down…

But not in this market!

See, these shortages give Apple cover to jack up prices and fatten their margins.

Think about it: do you really believe Apple will slash prices when supply comes back online?

When their margins are expanding and people can’t get enough of their iPhones?

Fat chance of that!

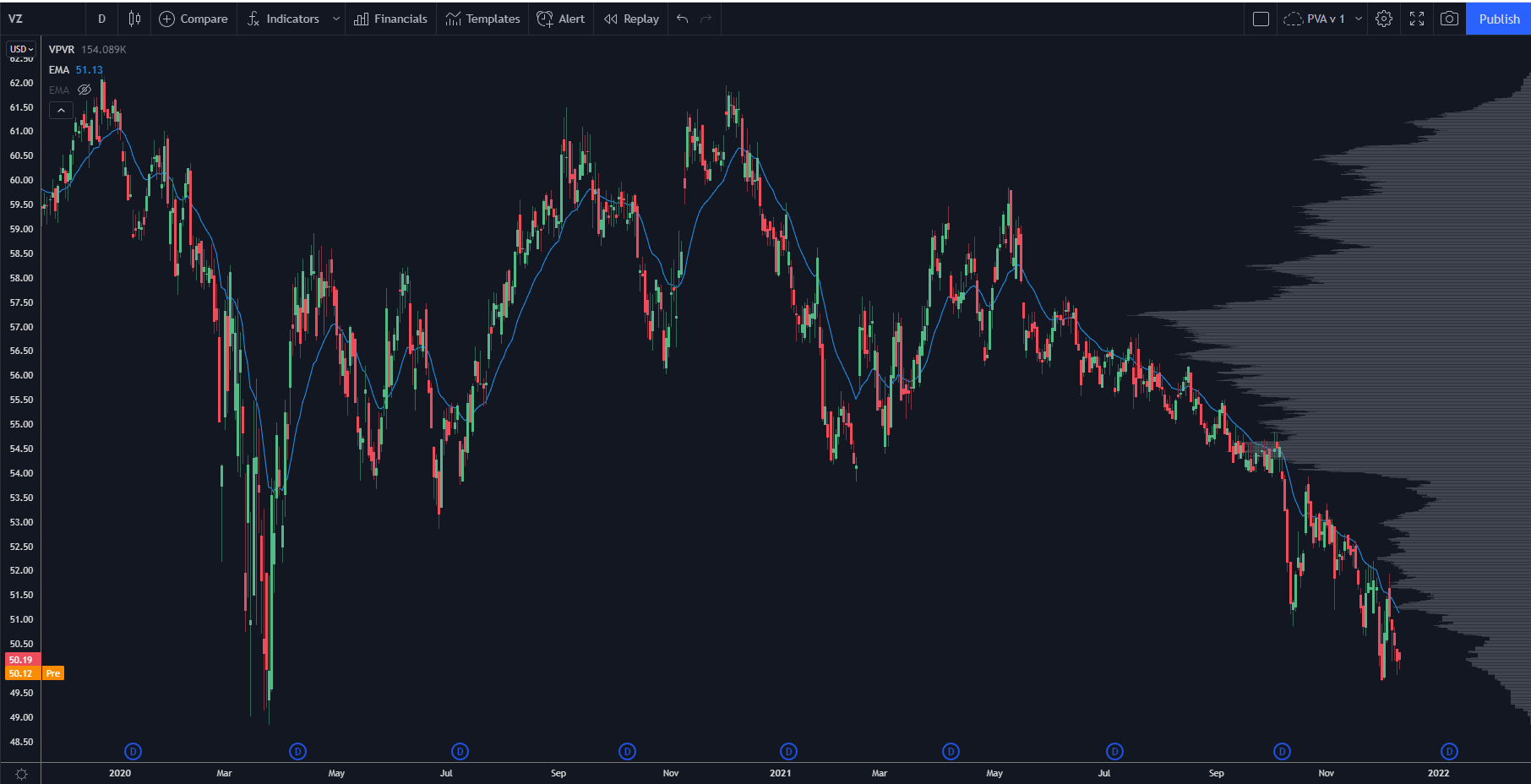

Instead, phone carriers like VZ — who no longer have negotiation power with Apple when it comes to giving customers iPhones — will feel the pain…

And their stock prices reflect that.

All that said:

We should be looking at companies that could benefit from structural supply chain shortages.

(I’ve laid out the full analysis in this video):

(If you prefer to read my analysis, continue):

I’m no economics expert.

Instead, I look for price action that’s responding to a particular narrative…

And the way I do that is through using our roadmap.

Now, one of the hottest sectors right now is in the shipping space.

These names are “trade it, don’t date it” kinds of stocks. Many of them have risks of secondaries and other kinds of dilutions into any rallies.

For me, the best way to look at this is to follow the price action.

One shipping company currently stands out from all the rest, as it’s in spitting distance of all-time highs.

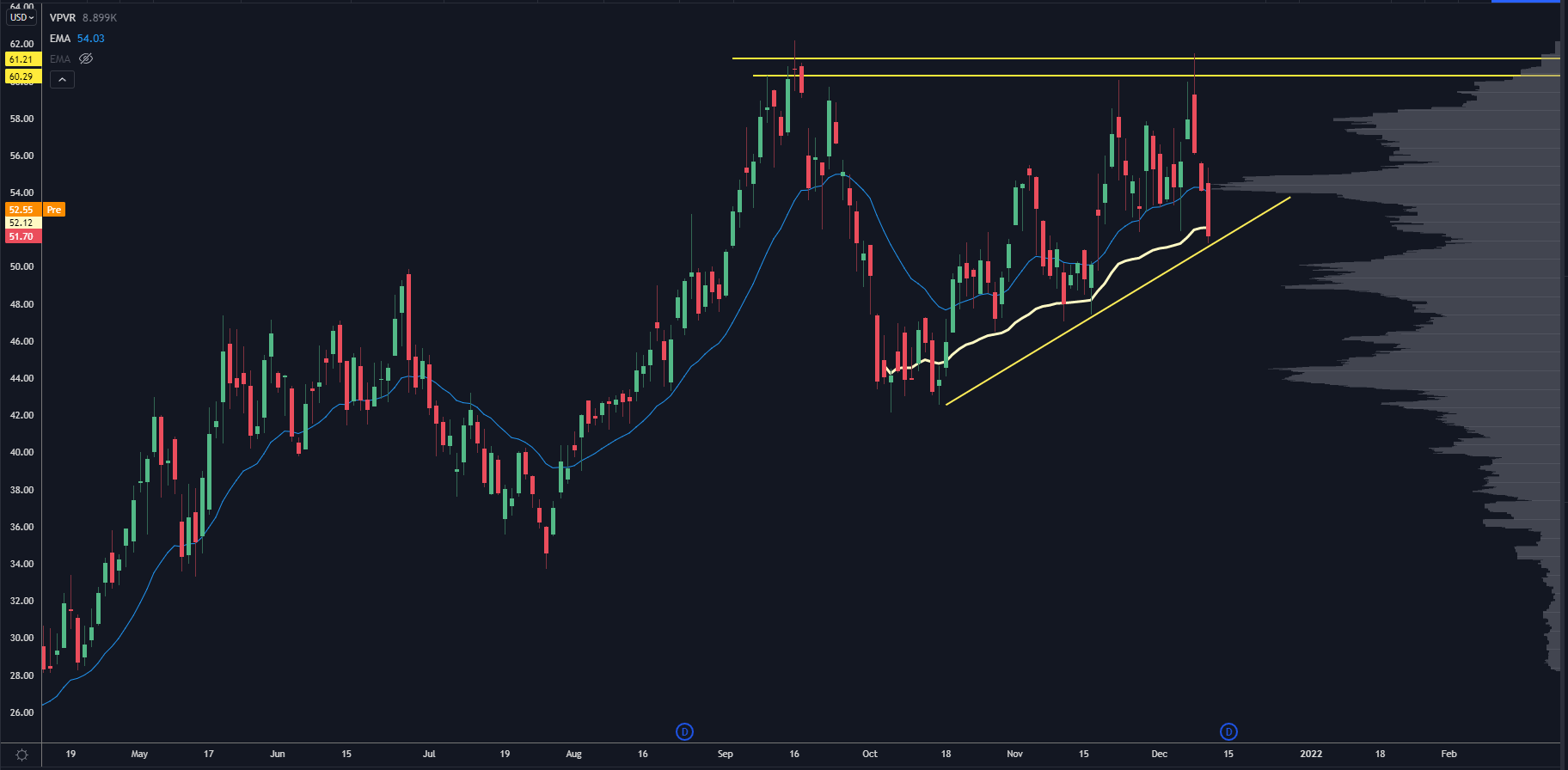

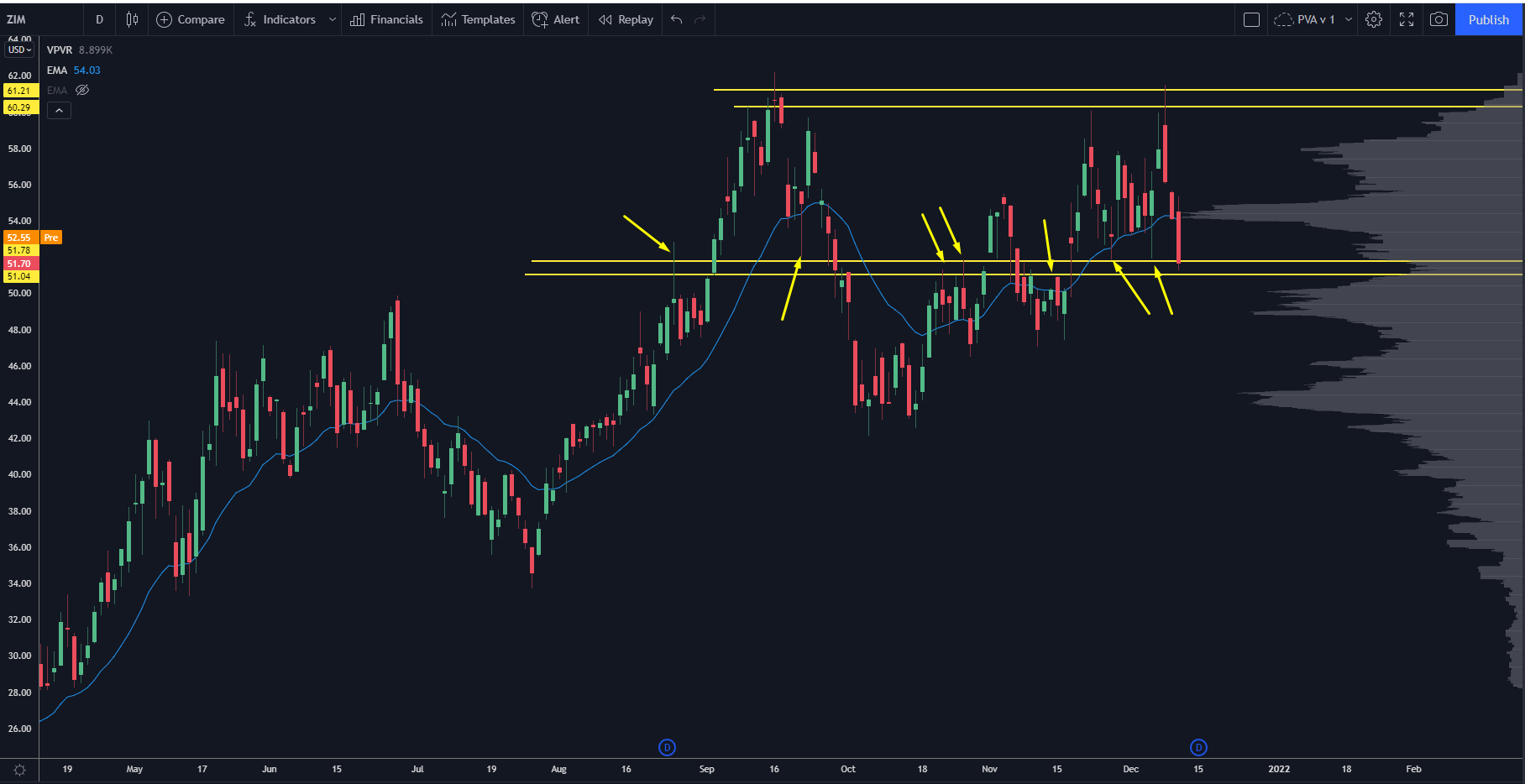

Take a look at ZIM Integrated Shipping Services (ZIM):

It’s on the verge of a massive breakout. There was a breakout attempt last week, but it failed because way too many traders were involved in the name and we needed a good stop-run.

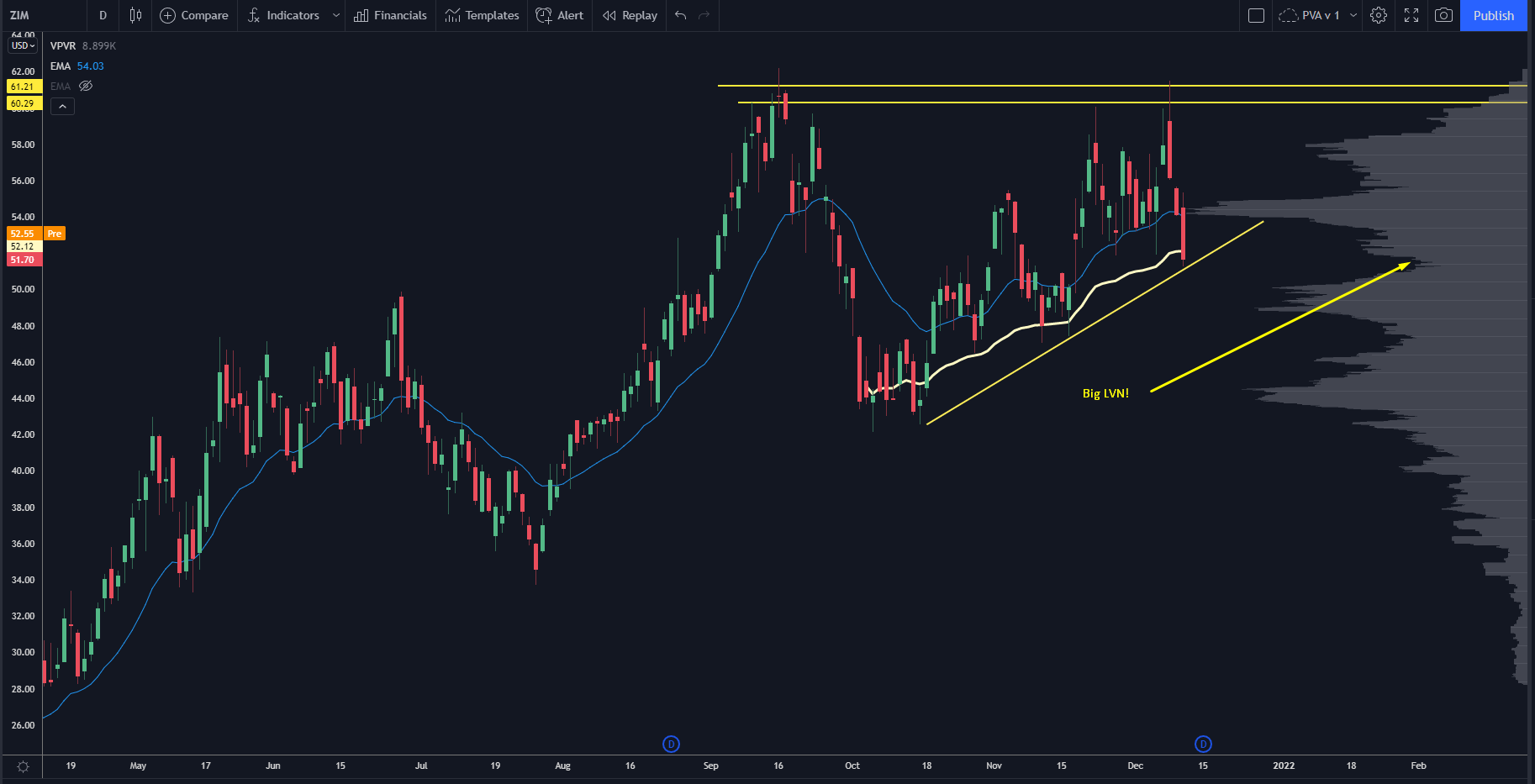

Yet I want to point out something on our roadmap:

See that yellow arrow?

There’s a very distinct low volume node (LVN) where the price is sitting. We often see responsive price action against this kind of level.

We’ve certainly seen it in the past:

This is a massive pivot level, and it’s currently my over-under for the stock.

If ZIM can hold this level this week, then it could be set up for a rebound back to the other end of the trading range at $60…

With the potential for a long-term breakout.

At Precision Volume Alerts, we haven’t yet entered a trade on ZIM since we’re watching short-term price action for signs of responsive buyers stepping in.

But if we see it, we’ll alert our clients to a long opportunity in the stock, which includes a call option buy to juice the returns…

With the potential to double, triple, or quadruple the returns on the risk taken in the trade!

If you’d like to see how we use our stock trading roadmap and learn how to access our PVA trade alerts, go check out our valuable training below:

Head here to watch that training.