We’re coming off a huge ripper of a market after the Fed raised rates by 25 basis points…

And honestly, I would’ve been OK with a 50-point jump.

You know — just rip the bandaid off and get it over with. After all, Jerome Powell already said they might have to do a 50-point hike in May. Why not do it sooner?

Oh, and the market’s pricing in something like 7 rate hikes this year, so this narrative isn’t going away…

But I’m not shocked to see rallies after these events because once uncertainty dissipates, we have no choice but to rally.

Now, there are some huge caution signs just around the corner many don’t see coming…

But we can see them clear as day on our Trading Roadmap.

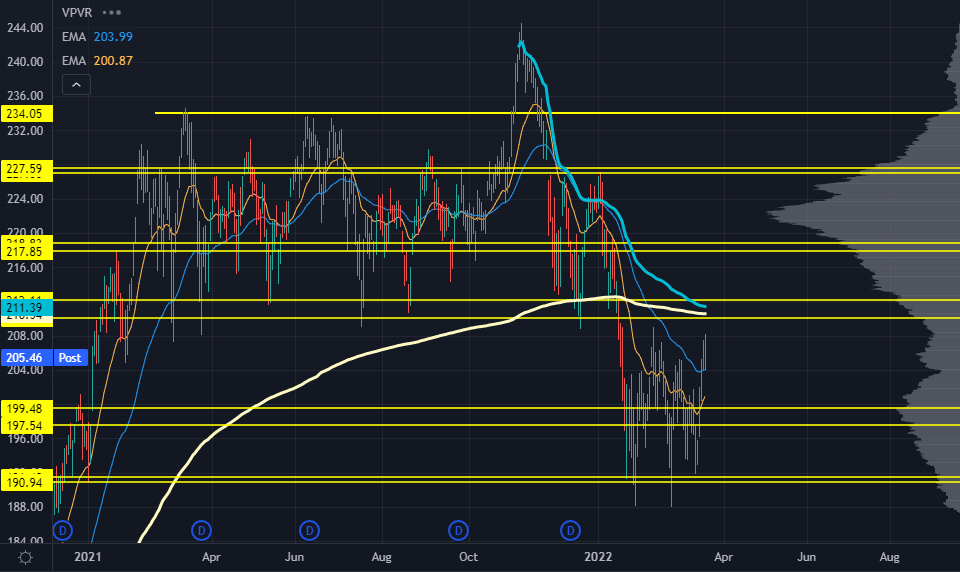

The first is the Russell 2000 index:

Anytime the Russell came into 210-212 for nearly an entire year, we found buyers.

With selling accelerating at the beginning of this year, we saw a breakdown underneath that level, and it hasn’t been tested quite yet.

That level will coincide with the swing Anchored Volume Weighted Average Price (AVWAP) from the Russell’s all-time highs and another internal AVWAP from the September 2020 lows.

The Russell’s seen some nice relative strength against the S&P and Nasdaq, so we’ve got to keep a close eye on this level to see if risk appetite can return for more than a few days.

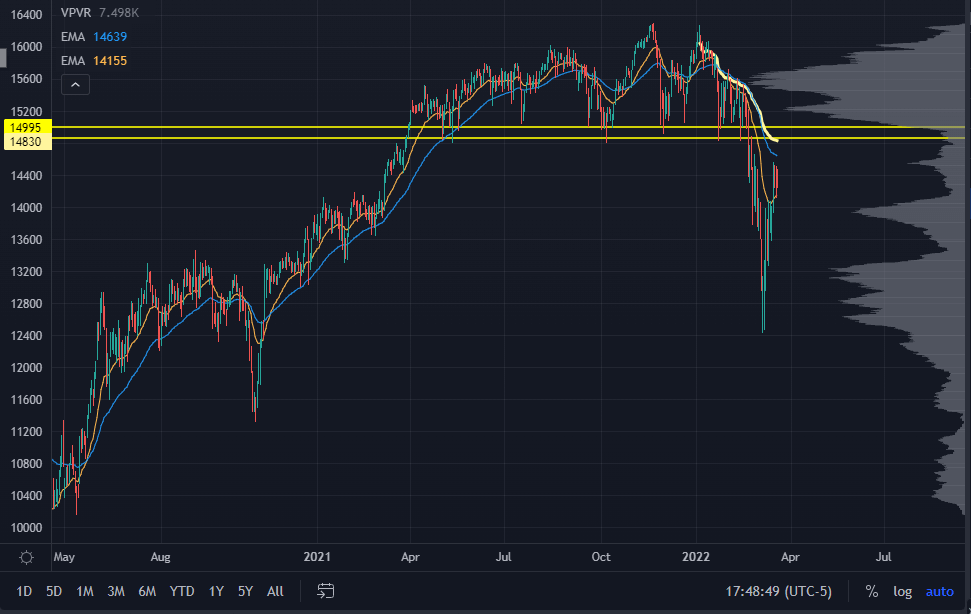

The next one to watch is the DAX:

The DAX market is a basket of 40 large-cap German stocks trading on the Frankfurt Stock Exchange. It’s kind of like the Dow Jones Industrial Average.

Germany’s important because it shows us proxy risk that comes from the Russia-Ukraine conflict. Germany gets a TON of gas from Russia, and as we’ve seen before, it has a very distinct risk if energy prices manage to stick.

The DAX has a different structure compared to US markets. It’s behaving more like a huge capitulatory V-bottom.

We’ve got a massive level at 15,000 — prior support, the swing AVWAP from all-time highs, and a monster volume shelf.

If you want to get some short exposure or lay on some more hedges, these could be great levels to play against.

And if you want to learn how to find more of these levels using our Roadmap: